Did you know that 30% of couples have experienced financial dishonesty, including secret purchases, undisclosed debts, and lies about income? This alarming statistic underscores the widespread issue of financial infidelity, which can severely harm a relationship. While it may not garner as much focus as romantic or sexual infidelity, the repercussions of financial infidelity can be just as, if not more, devastating, resulting in considerable emotional turmoil and a loss of trust within the relationship.

Key Takeaways:

- Financial infidelity is a widespread issue, with 30% of couples experiencing lies related to finances.

- Financial infidelity can be as damaging as an affair, causing deep emotional pain and eroding trust in the relationship.

- It involves behaviors such as secret purchases, hidden debts, and dishonesty about income.

- The impact of financial infidelity can be compared to an affair, with long-lasting emotional consequences.

- Open communication and transparency are essential in preventing and addressing financial infidelity in relationships.

The Prevalence of Financial Infidelity

A survey conducted by US News & Report found that 30% of couples have experienced financial infidelity in their relationship. The most common forms of financial infidelity include secret purchases, hidden debts, and dishonesty about income. The study also revealed that this issue is not limited to the United States, as similar research in the UK found that one in five people lied to their partner about their earnings and one in four lied about their debt.

| United States | United Kingdom | |

|---|---|---|

| Lied about earnings | 30% | 20% |

| Lied about debt | 30% | 25% |

Coercive Control and Poor Communication

Financial infidelity can often be intertwined with coercive control within a relationship. Coercive control occurs when one person seeks to dominate and manipulate the decisions of the other through various means. In the context of financial infidelity, the controlling partner may deliberately hide key financial information to assert power and control over their significant other.

Poor communication around money is another significant factor contributing to financial infidelity. Couples who struggle to openly discuss their financial obligations, goals, and struggles may find themselves resorting to deceitful behavior as a coping mechanism or to avoid conflict. Shame and embarrassment associated with debt or financial struggles may further hinder effective communication about money matters.

“Lack of trust and lack of open communication around financial matters can be a significant barrier in relationships. It creates a toxic environment where financial infidelity can thrive.”

– Susanna Abse, Psychotherapist

The reasons behind engaging in financial infidelity can vary from one individual to another. While the root causes might not always be clear, it is important to recognize that financial infidelity can also be driven by other lies and addictions, such as gambling or sex addiction. These underlying issues can further complicate the dynamics of a relationship, making it crucial to address them alongside the financial deceit.

The Link Between Financial Infidelity and Coercive Control

In situations where financial infidelity is rooted in coercive control, the controlling partner exerts power by manipulating the flow of financial information. By withholding or misrepresenting important financial details, they limit their partner’s ability to make informed decisions about money. This form of abuse can deepen the power imbalance within the relationship, eroding the victim’s autonomy and exacerbating the emotional toll of financial infidelity.

Research shows that financial abuse is often present in relationships with coercive control, creating a complex and harmful dynamic. It is crucial for individuals experiencing coercive control and financial infidelity to seek support and find ways to safely assert their autonomy and regain control over their financial lives.

Understanding the link between coercive control and financial infidelity underscores the importance of addressing not only the financial deceit but also the underlying power imbalances in a relationship. Open communication, trust, and professional assistance can help individuals navigate these difficult circumstances and work towards building healthier relationship dynamics.

| Forms of Coercive Control | Examples |

|---|---|

| Isolation | Prohibiting or limiting contact with friends, family, or support networks |

| Intimidation | Threats, physical or verbal abuse, damaging property |

| Manipulation | Guilt-tripping, gaslighting, distorting the truth |

| Economic control | Controlling access to money, withholding financial resources, monitoring expenses |

Changes in Couples’ Financial Dynamics

The way couples handle money has evolved significantly over the past few decades. With more women in the workforce, traditional norms of joint bank accounts and shared finances have given way to increased autonomy and less emphasis on sharing.

Couples now negotiate their financial dynamics based on their individual needs and preferences. This shift towards autonomy allows each partner to have a sense of control over their own finances, making decisions that align with their personal goals and values. It also fosters a sense of independence and self-reliance within the relationship.

However, this change in financial dynamics brings its own set of challenges. Couples must now navigate the complexities of establishing levels of autonomy and transparency. Finding the right balance between individual financial freedom and maintaining open communication and transparency can be a delicate process.

Autonomy allows couples to have a greater sense of personal responsibility and freedom when it comes to money management. Each partner can make decisions without having to consult or seek permission from the other. This can lead to a more harmonious relationship, where each individual feels empowered and in control of their financial life.

On the other hand, transparency is crucial for maintaining trust and avoiding potential conflicts. It involves open and honest communication about income, expenses, debts, and financial goals. Transparency creates a shared understanding of the couple’s financial situation and fosters a sense of joint responsibility for their financial well-being.

Striking the right balance between autonomy and transparency is essential for a healthy financial dynamic. Couples must find a middle ground where they can maintain their individual financial autonomy while keeping each other informed and involved in important financial decisions.

“Financial independence and transparency go hand in hand in a successful relationship. Couples should cultivate open communication about money matters while respecting each other’s autonomy.”

To better illustrate the changes in couples’ financial dynamics, consider the following table:

| Couples’ Financial Dynamics | Traditional Approach | Modern Approach |

|---|---|---|

| Joint Bank Accounts | One shared account for all finances | Individual and/or joint accounts based on personal preferences |

| Decision Making | Joint decisions on all financial matters | Individual decisions with open communication and consultation |

| Financial Responsibility | Shared responsibility for all expenses | Individual responsibility with shared commitments |

| Budgeting | Strict adherence to a joint budget | Individual and/or joint budgeting based on personal preferences |

This table highlights the contrast between the traditional and modern approaches to couples’ financial dynamics. While the traditional approach emphasizes joint accounts, shared decision-making, and strict adherence to a joint budget, the modern approach allows for more individual autonomy and flexibility in managing finances. Couples can now customize their financial arrangement to suit their unique needs and preferences, promoting a healthier and more harmonious financial relationship.

The Emotional Impact of Financial Infidelity

Financial infidelity can have a devastating emotional impact on individuals and their relationships. The discovery of hidden debts or dishonesty about financial matters can shake the very foundation of trust that a relationship is built upon. This betrayal can lead to a range of negative emotions, such as anxiety, anger, sadness, and embarrassment.

When someone realizes that their partner has been financially unfaithful, it raises doubts about every aspect of the relationship. They may question whether their partner’s intentions were genuine, if their financial stability is at risk, and if they can truly trust them moving forward.

The emotional toll of financial infidelity can persist long after the relationship ends and the financial consequences are resolved. The feelings of betrayal and insecurity can linger, making it difficult for individuals to fully trust future partners. This emotional baggage may also affect their self-esteem and ability to engage in future financial relationships.

One individual shared, “Discovering my partner’s hidden debts made me question everything. I felt betrayed and uncertain about our financial stability. It took a long time for me to regain trust, not only in him but also in myself and my ability to make sound financial decisions.”

Furthermore, financial infidelity often brings with it a sense of embarrassment and shame. Individuals may feel embarrassed about being deceived or unable to recognize the signs. They may also feel ashamed of the financial mess they find themselves in and the implications it has on their overall well-being.

“Finding out about the debt my partner had hidden made me feel so embarrassed and foolish. I trusted him completely, and it was devastating to realize that he had been lying to me all along. I felt like I had been taken advantage of, and it took a toll on my self-esteem.”

Rebuilding trust after financial infidelity can be a challenging and lengthy process. It requires open and honest communication, transparency about financial matters, and a commitment to rebuilding the relationship on a solid foundation of trust.

| Emotional Impact of Financial Infidelity | Ways to Overcome the Emotional Impact |

|---|---|

| Anxiety | Open and honest communication |

| Anger | Counseling or therapy |

| Sadness | Setting boundaries and expectations |

| Embarrassment | Working on self-esteem and confidence |

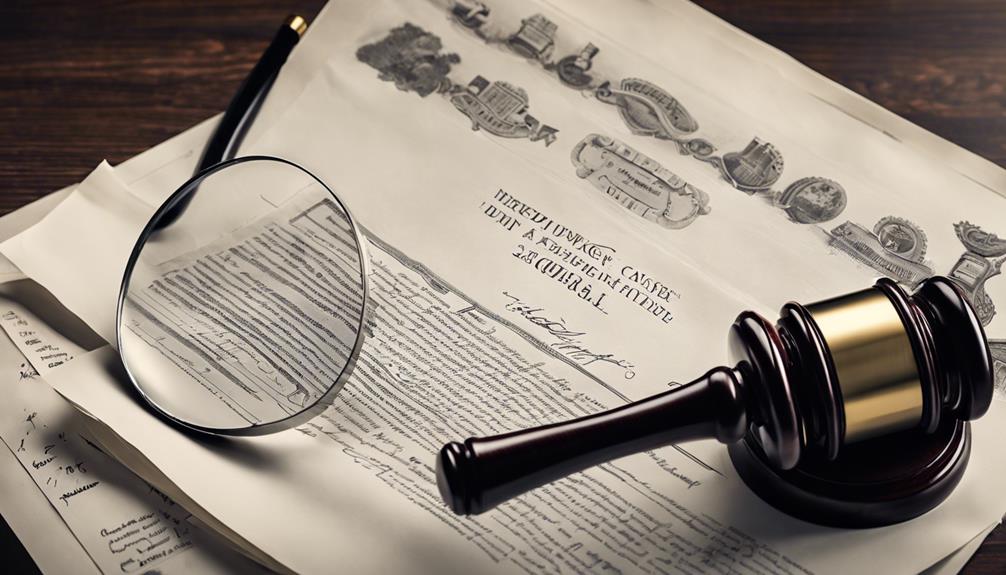

Legal Ramifications of Financial Infidelity in Divorce

During divorce proceedings, financial infidelity often surfaces as couples are obligated to reveal their financial information. In some instances, one partner may have accumulated substantial debt without the knowledge of the other. Unfortunately, when it comes to divorce settlements, the court can only work with the assets that exist, and if one partner has spent all the money, it cannot be recovered.

While there may be provisions to consider reckless spending in some cases, the threshold for including these expenses is high. Additionally, addiction-related spending may be exempted from being added back. Divorce can further magnify the financial consequences of hidden spending, leading to significant challenges in achieving a fair and equitable division of assets.

“The court can only distribute the assets that exist at the time of the divorce. If one spouse has spent all the money through financial infidelity, it becomes extremely difficult to recover anything substantial.”

Hidden spending and undisclosed debts can significantly impact the financial outcomes of divorce settlements, leaving one partner at a disadvantage. Divorce attorneys often advise their clients to conduct thorough investigations to uncover any instances of financial infidelity and ensure a fair resolution.

The Importance of Open Communication in Financial Matters

Open communication is crucial in maintaining a healthy financial dynamic within a relationship. Many individuals may not realize that financial secrecy, whether it involves hidden earnings or secret savings, is not sustainable in the long run. In marriage and divorce, financial information must be disclosed, and secrecy only leads to further complications.

Couples are advised to openly discuss their financial goals, spending habits, and debts to build trust and avoid future conflicts. By promoting financial transparency and fostering a culture of open communication, couples can navigate their financial journey together, ensuring that both partners feel heard and valued.

Financial transparency goes beyond simply sharing bank account statements or credit card bills. It means engaging in open and honest conversations about financial goals, priorities, and plans for the future. This level of relationship requires vulnerability and trust, as it involves discussing not only income and expenses but also deeper values and aspirations.

“Financial transparency is an essential ingredient for a successful relationship. It lays the foundation for open communication, trust, and shared decision-making. Couples who are open about their finances are better equipped to handle challenges and work together towards their common goals.” – John Anderson, Relationship Coach

Open communication can help couples avoid unexpected surprises and prevent misunderstandings that can strain a relationship. Discussing financial matters openly allows couples to address any disparities in income, spending habits, and financial priorities. It also provides an opportunity to create joint financial goals and plan for major expenses, such as buying a house or saving for retirement.

In addition to building trust and fostering mutual understanding, open communication about finances creates a sense of shared responsibility. It allows couples to allocate resources effectively, make informed decisions, and prevent financial conflicts from escalating into larger relationship issues.

By openly discussing financial matters, couples can ensure that they are on the same page and working together towards a secure financial future. Open communication creates a solid foundation for a healthy and harmonious relationship, enabling partners to face financial challenges as a team.

Key Points:

- Financial secrecy is not sustainable in the long run and can lead to complications in relationships.

- Openly discussing financial goals, spending habits, and debts can build trust and prevent conflicts.

- Financial transparency fosters open communication, trust, and shared decision-making.

- Open communication about finances allows couples to address disparities, create joint goals, and plan for the future.

- Open communication creates a foundation for a healthy and harmonious relationship.

Underlying Motivations for Financial Infidelity

Financial infidelity can arise from various motivations, driven by impulses or emotional insecurities. Individuals engaging in financial infidelity may feel the need to rebel against financial norms or assert their independence. For some, impulsive spending becomes a way to display their purchasing power or cope with underlying feelings of inadequacy. Insecurity can also play a significant role, as individuals may equate financial success with personal worth, leading to a constant pursuit of earning more.

On the other hand, financial infidelity can stem from the fear of admitting financial struggles or a lack of resources. Some individuals accumulate debt covertly, unable to admit their financial difficulties due to shame or embarrassment. This insecurity often prevents them from seeking help or discussing their financial challenges openly.

Ultimately, understanding the motivations behind financial infidelity is essential to address and resolve the underlying issues. By fostering open communication and addressing insecurities and impulses, individuals can work towards building healthier financial behaviors and stronger relationships.

Conclusion

Financial infidelity can have a profound impact on a relationship. The emotional pain caused by this betrayal often surpasses that of an affair. The prevalence of financial infidelity highlights the urgent need for open communication and transparency in financial matters. Couples must actively navigate their financial dynamics, taking into account each other’s needs and maintaining trust.

Building a healthy financial dynamic requires addressing underlying motivations behind financial infidelity. Whether it stems from impulsive spending, insecurity, or defiance, understanding these motivations is crucial for overcoming the challenges posed by financial infidelity. By fostering open communication, couples can create a stronger foundation for their relationship.

Transparency and trust are the cornerstones of a successful financial partnership. Discussing financial goals, spending habits, and debts openly can prevent conflicts and ensure both partners are on the same page. Establishing a healthy financial dynamic requires ongoing effort and commitment, but the rewards are worth it. By working together, couples can strengthen their relationship and navigate the complexities of financial infidelity.

How Can Financial Infidelity Impact Relationships and Trust?

Financial infidelity can erode trust and fracture relationships. It creates a barrier to open communication and mutual understanding. In order to address these issues, it’s important to be in stillness and hear intuition. By acknowledging and respecting each other’s concerns, trust can be rebuilt, and relationships can be strengthened.

FAQ

What is financial infidelity?

Financial infidelity refers to dishonesty or deceit related to money within a relationship. It can involve secret purchases, hidden debts, or lying about income.

How common is financial infidelity?

According to a survey, 30% of couples have experienced financial infidelity in their relationship, indicating that it is a widespread issue.

What are the common forms of financial infidelity?

The most common forms of financial infidelity include secret purchases, hidden debts, and dishonesty about income.

What can contribute to financial infidelity?

Financial infidelity can be a manifestation of coercive control, poor communication around money, or the shame associated with debt. It can also be driven by other lies and addictions, such as gambling or sex addiction.

How does financial infidelity impact a relationship?

Financial infidelity can erode trust, cause emotional pain and anxiety, and undermine the foundation of a relationship. The impact can be compared to that of an affair.

What are the legal consequences of financial infidelity in divorce?

Financial infidelity can result in one partner accumulating significant debt without the other’s knowledge, which can affect divorce settlements. While there are provisions to address reckless spending, the threshold is high, and addiction-related spending may be exempted.

How important is open communication in financial matters?

Open communication is crucial in maintaining a healthy financial dynamic within a relationship. Financial secrecy is not sustainable in the long run and can lead to further complications, particularly in marriage and divorce where financial information must be disclosed.

What are some underlying motivations for financial infidelity?

Financial infidelity can stem from motivations such as defiance, self-assertion, display, insecurity, and retaliation. Some individuals may equate financial security with a specific amount of money, while others may accumulate debt due to a lack of resources.