Did you know that it is possible to keep receiving alimony payments even after the death of a former spouse? This fact is often overlooked by many. In a divorce case, a spouse who is seeking alimony may be eligible for these payments if ordered by the court. However, certain circumstances, such as the remarriage of the spouse seeking alimony, can result in the termination of these payments. It is important for the supported spouse to establish a strong financial base. This article explores the process of receiving alimony from an ex-spouse and the crucial financial support after a divorce.

Key Takeaways:

- Alimony can be received even after the death of an ex-spouse.

- A requesting spouse may be eligible for alimony if ordered by the court.

- Certain circumstances, such as remarriage, can terminate alimony payments.

- Having a significant income is crucial to secure financial position.

- Consulting with a divorce lawyer is advisable for guidance through the process.

What Happens to Alimony when the Paying Spouse Dies?

In some cases, the death of the paying spouse does not automatically eliminate alimony payments if the court has also ordered child support payments. Child support is usually not terminated during the child’s minority and can be enforced even after the death of the paying spouse. The child support can be modified in court if there are changes in circumstances. However, for the requesting spouse to continue receiving spousal support after the death of the ex-spouse, it is important to consult with a divorce lawyer who specializes in probate law.

How to Claim Spousal Support after the Paying Spouse’s Death

If the paying spouse dies without fulfilling their alimony obligations, you still have options to claim the unpaid support. As the requesting spouse, you can seek payment from the estate of the deceased ex-spouse by filing a creditor’s claim against their probate estate.

Filing a creditor’s claim is an important step to secure the unpaid alimony. It allows you to legally assert your right to receive the funds owed to you. By submitting the claim, you position yourself as a priority creditor and increase your chances of obtaining the unpaid alimony from the estate.

It is crucial to consult with an experienced divorce lawyer who specializes in probate law to guide you through the claim process. They can provide valuable insights and ensure that you follow the necessary legal procedures to assert your right to the unpaid alimony.

Remember, claiming unpaid alimony from the probate estate is a legal right that protects your financial interests. By taking appropriate action, you can secure the financial support you are entitled to even after the paying spouse’s death.

Understanding Probate Estate

Before discussing the procedure for claiming your unpaid alimony, let’s understand what a probate estate is.

The term “probate estate” refers to the assets and liabilities left by a deceased individual. When someone passes away, their estate goes through probate, which is the legal process for administering the estate and distributing assets according to the provisions in the will or state laws.

During probate, the court appoints an executor or personal representative to manage the estate. The executor handles various tasks, including paying off outstanding debts and distributing assets to the rightful beneficiaries.

As the requesting spouse seeking unpaid alimony, you must file your claim against the probate estate to assert your right to receive the support owed to you.

| Step | Action |

|---|---|

| 1 | Hire a divorce lawyer specializing in probate law. |

| 2 | Identify the court overseeing the probate process. |

| 3 | File a creditor’s claim against the estate. |

| 4 | Provide necessary documentation supporting your claim, such as court orders or agreements. |

| 5 | Attend any hearings or court proceedings related to your claim. |

| 6 | Follow up with your lawyer regarding the progress of your claim. |

By following these steps and working closely with your lawyer, you can navigate the probate process successfully and claim the unpaid alimony from the estate of the paying spouse.

How Does the Probate Process Work?

When the paying spouse dies, the state initiates the probate process to distribute the deceased person’s estate. The court appoints an administrator to oversee the distribution of assets and the payment of outstanding debts. The requesting spouse can claim their unpaid alimony during this process by submitting a claim against the estate.

Understanding the Probate Process

The probate process is a legal procedure that takes place after someone’s death. It involves proving the validity of the deceased person’s will, identifying their assets and liabilities, and distributing their estate according to the will or state laws. The court appoints an administrator, also known as an executor, to handle these tasks.

During the probate process, the administrator’s primary responsibilities include:

- Gathering and inventorying the deceased person’s assets

- Paying off outstanding debts and taxes

- Distributing the remaining assets to the beneficiaries

Claiming Unpaid Alimony

If the paying spouse passed away without paying the owed alimony, the requesting spouse can claim the unpaid amount from the deceased ex-spouse’s estate. To do this, the requesting spouse needs to submit a claim against the estate during the probate process.

Here’s a step-by-step guide on how to claim unpaid alimony during the probate process:

- Consult an attorney: It’s essential to seek legal guidance during this process to ensure you understand your rights and obligations.

- File a creditor’s claim: Prepare the necessary paperwork and submit a creditor’s claim to the probate court. The claim should clearly state the amount of unpaid alimony and provide supporting documentation.

- Attend probate hearings: Stay informed about the progress of the probate process by attending the probate hearings related to the estate. This allows you to address any issues or disputes that may arise.

- Receive payment: If the court approves your claim, you will receive payment for the unpaid alimony from the estate.

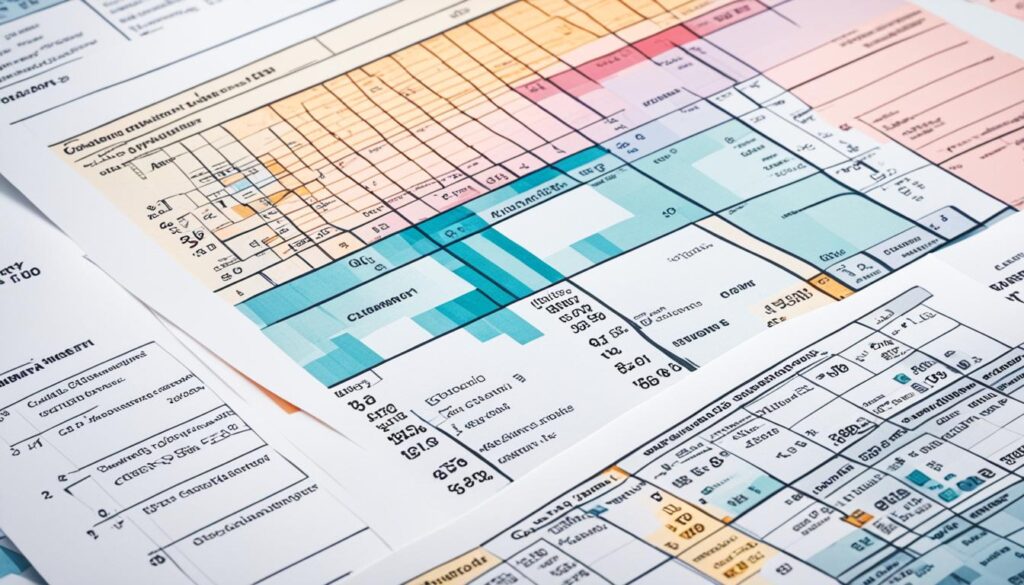

Example of Probate Process Timeline and Creditor’s Claim

| Probate Process Milestones | Timeline |

|---|---|

| Initial Probate Petition filed | Within 30 days of the deceased person’s death |

| Probate court hearings | Varies depending on court availability and complexity of the estate |

| Creditor’s Claim filed | Within a specified period after the deceased person’s death (varies by state, typically 3-9 months) |

| Court’s decision on the Creditor’s Claim | Varies depending on the court’s schedule and workload |

| Payment of approved claims | After the court’s decision, usually within a few months |

How to Secure Spousal Support Before Death

To ensure the continuation of spousal support even after the paying spouse’s death, it is advisable for the requesting spouse to take certain steps. These can include preparing a separation agreement that states the paying spouse is required to continue making spousal support payments even after their death by utilizing their estate. It is also possible to involve the court and obtain a court order that specifies the paying spouse’s liability for spousal support after death.

By preparing a separation agreement, the requesting spouse can secure their financial future by legally binding the paying spouse to fulfill their spousal support obligations even in the event of their death. This agreement can outline the terms and conditions for the continuation of support, ensuring the requesting spouse’s financial stability remains intact.

Alternatively, involving the court and obtaining a court order can provide added security for spousal support. A court order can enforce the paying spouse’s responsibility to continue making payments after their death. This legal document carries the weight of the court’s authority, providing the requesting spouse with a strong legal basis to secure ongoing financial support.

It is important to consult with a divorce lawyer to ensure that the separation agreement or court order is properly prepared and executed. A skilled attorney can guide the requesting spouse through the process, ensuring their rights are protected and their financial well-being is secured.

| Pros | Cons |

|---|---|

| Provides a legally binding agreement for spousal support continuation | May involve additional legal and court costs |

| Ensures financial stability for the requesting spouse in case of the paying spouse’s death | Requires cooperation and agreement from both parties |

| Strong legal basis for enforcing spousal support after death | May require ongoing legal maintenance and updates |

Understanding the Different Types of Alimony

Alimony, also known as spousal support or maintenance, can be categorized into different types based on the purpose and duration of the payments. Understanding these different types will help you navigate the complexities of post-divorce financial support. Here are some common types of alimony:

Durational Alimony:

This type of alimony is awarded for a specific period of time, usually to provide support during a transitional phase after divorce. It is often granted when one spouse needs time to become financially independent or to adjust to changes in their lifestyle.

Rehabilitative Alimony:

Rehabilitative alimony is intended to support the recipient spouse in obtaining education or acquiring skills that will help them become self-sufficient. It is awarded with the objective of assisting the spouse to re-enter the workforce or pursue career advancement opportunities.

Permanent Alimony:

Permanent alimony is typically awarded in cases where one spouse is unable to support themselves due to age, disability, or other reasons. It is intended to provide ongoing financial support and can last until the recipient spouse remarries or passes away.

Reimbursement Alimony:

Reimbursement alimony is awarded when one spouse has made significant contributions to the marriage that have benefited the other spouse, such as supporting their education or career development. It is meant to compensate the contributing spouse for their efforts and sacrifices made during the marriage.

Understanding the different types of alimony can help you anticipate the potential financial support you may receive or be obligated to provide after a divorce. It is important to consult with a divorce lawyer who can guide you through the alimony determination process and ensure that your rights and interests are protected.

How Long Does Alimony Last?

The duration of alimony payments can vary depending on several factors, including the length of the marriage and the specific circumstances of the parties involved. In general, alimony is typically awarded for a period ranging from one-third to half the duration of the marriage. For example, if a couple was married for 12 years, the court may order alimony payments for a period of 4 to 6 years.

However, it’s important to note that alimony can be ordered to last for the recipient’s lifetime if they are elderly or disabled. This is done to ensure that individuals who are unable to support themselves due to age or disability continue to receive the necessary financial assistance.

It’s also essential to understand that alimony can be terminated under specific circumstances. One common scenario is if the recipient spouse decides to remarry. In this case, the financial support provided through alimony may no longer be necessary or appropriate. Additionally, if either party passes away, it can lead to the termination of alimony payments.

| Factors Influencing Alimony Duration | Examples |

|---|---|

| Length of the marriage | A 10-year marriage may result in alimony payments lasting 3-5 years. |

| Age and health of the recipient | An elderly or disabled spouse may receive alimony for their lifetime. |

| Contributions made during the marriage | If one spouse supported the other’s education or career, alimony may be awarded for a longer duration. |

Ultimately, the duration of alimony payments is determined on a case-by-case basis, and the court takes into account various factors to ensure a fair and reasonable outcome for both parties involved.

Factors Considered in Determining Alimony Amount

When determining the amount of alimony, courts consider several factors. These factors play a crucial role in ensuring a fair and equitable distribution of financial support. Understanding these factors is essential for both the recipient spouse seeking alimony and the paying spouse.

Financial Need: One of the primary considerations for determining alimony is the financial need of the recipient spouse. The court examines the recipient’s financial situation, including their income, assets, and liabilities. It assesses whether they require financial support to maintain a standard of living similar to that during the marriage.

Ability to Pay: The court also evaluates the paying spouse’s ability to meet the alimony obligation. This assessment involves examining their income, assets, and financial responsibilities, such as child support or other financial obligations. The court ensures that the paying spouse can afford to make the alimony payments without suffering undue financial hardship.

Standard of Living: The standard of living enjoyed during the marriage is another critical factor. The court considers the lifestyle maintained by both spouses when determining the appropriate alimony amount. It seeks to provide the recipient spouse with the means to sustain a comparable standard of living after the divorce.

Earning Capacities: The earning capacities of both parties are evaluated. The court examines the skills, education, work experience, and potential for future employment or career advancement. It acknowledges any disparities in earning capacities and may award higher alimony to mitigate the financial discrepancy.

Age and Health: The age and health of both spouses are taken into account. The court acknowledges that age and health can affect the ability of the recipient spouse to support themselves financially. It considers factors such as the recipient’s employability, potential medical expenses, and other relevant health-related considerations.

Contributions to the Marriage: The contributions made by each spouse during the marriage are also considered. This includes both financial contributions and non-financial contributions, such as homemaking, childcare, or support in furthering the other spouse’s education or career. The court recognizes and values these contributions when determining the appropriate alimony amount.

By taking these factors into account, the court aims to establish a fair and reasonable alimony amount that considers the financial needs of the recipient and the ability of the paying spouse to meet those needs. It ensures that alimony calculations are based on comprehensive evaluations rather than arbitrary decisions.

Is Alimony Taxable?

The Tax Cuts and Jobs Act of 2017 brought significant changes to the tax treatment of alimony. Understanding the tax consequences of alimony is crucial for both the paying spouse and the recipient. For divorces finalized in 2019 and after, alimony payments are no longer tax-deductible for the paying spouse, and they are no longer considered taxable income for the recipient. This change has important implications for the financial planning of individuals involved in divorce proceedings.

“The Tax Cuts and Jobs Act of 2017 brought significant changes to the tax treatment of alimony.”

This alteration in the tax code can have a substantial impact on the financial outcomes of divorces. With alimony no longer being tax-deductible, the paying spouse may experience increased financial pressure as they can no longer offset the payments against their taxable income. Conversely, the recipient spouse will no longer have to report alimony as taxable income, resulting in potentially greater financial flexibility.

It’s important to note that this change in tax treatment applies to divorces finalized in 2019 and later, as well as modifications made in 2019 or later to divorces that occurred before 2019. Therefore, if you are finalizing a divorce or considering modifying an existing divorce agreement, be sure to consult with a knowledgeable tax professional to fully understand the applicable tax consequences of alimony.

Example Table: Comparison of Alimony Tax Treatment

| Year | Paying Spouse | Recipient Spouse |

|---|---|---|

| Before 2019 | Tax-deductible | Taxable income |

| 2019 and after | Not tax-deductible | Not taxable income |

As shown in the table above, the tax consequences of alimony have changed significantly with the Tax Cuts and Jobs Act. It is essential for individuals navigating the complexities of divorce to seek professional advice to ensure they fully understand the implications of these tax changes on their financial circumstances.

How to Enforce an Alimony Award

If an ex-spouse fails to comply with court-ordered alimony payments, the recipient has options for enforcing the award and ensuring financial support. One avenue is through contempt of court proceedings. By initiating contempt of court, the recipient can seek legal consequences for the non-paying spouse.

In contempt of court proceedings, the judge can issue a judgment for the unpaid alimony amount. This judgment holds the non-paying spouse accountable for their financial obligations and can result in various penalties, including fines or even jail time in severe cases.

Another method for enforcing alimony is through income withholding. This involves the court ordering the non-paying spouse’s employer to deduct the alimony amount directly from their paycheck and remit it to the recipient. Income withholding provides a consistent and reliable means of receiving alimony payments.

In some cases, the recipient may need to take more aggressive action to collect unpaid alimony. One option is to obtain a writ of execution. This legal document allows the recipient to seize the non-paying spouse’s assets. The assets can be sold, and the proceeds used to satisfy the outstanding alimony debt.

To better understand the process and navigate the complexities of enforcing an alimony award, it is crucial to consult with a knowledgeable divorce attorney. They can provide guidance tailored to the specific circumstances and help ensure the recipient’s rights are protected.

Example Table: Legal Mechanisms for Enforcing Alimony

| Enforcement Method | Description |

|---|---|

| Contempt of Court | Initiating legal proceedings that can result in penalties or even jail time for the non-paying spouse. |

| Income Withholding | The court orders the non-paying spouse’s employer to deduct the alimony amount from their paycheck and remit it to the recipient. |

| Writ of Execution | Obtaining a legal document that allows the recipient to seize the non-paying spouse’s assets to satisfy the outstanding alimony debt. |

Conclusion

Securing alimony from a husband after a divorce is crucial for ensuring financial support for the requesting spouse. Understanding the different types of alimony, the factors considered in determining the amount, and the options for enforcing alimony awards are key in navigating the legal process of securing alimony.

By consulting with a divorce lawyer, individuals can receive guidance and professional assistance in pursuing their rightful financial support. A lawyer specializing in family law can provide valuable insights, help negotiate fair terms, and ensure that all legal requirements are met.

Whether it’s durational or rehabilitative alimony, it’s essential for the requesting spouse to be aware of their rights and entitlements. With proper legal representation, they can assert their position and secure the financial stability they need after a divorce.

In conclusion, securing alimony ensures that post-divorce financial support is obtained. Understanding the implications of different alimony types, the factors influencing the amount, and the available legal options are all crucial in navigating the process successfully. By seeking professional advice, individuals can protect their financial interests and secure the alimony they deserve.

FAQ

How can I secure alimony from my husband after a divorce?

To secure alimony from your husband after a divorce, you can take several steps. These include preparing a separation agreement that specifies that your husband is required to continue making spousal support payments even after his death by utilizing his estate. You can also involve the court and obtain a court order that specifies your husband’s liability for spousal support after his death.

What happens to alimony when the paying spouse dies?

In general, the death of the paying spouse does not automatically terminate alimony payments. However, if the court has also ordered child support payments, these payments will continue even after the death of the paying spouse. To continue receiving spousal support after the death of the ex-spouse, it is important to consult with a divorce lawyer who specializes in probate law.

How can I claim spousal support after the paying spouse’s death?

If the paying spouse dies without paying alimony, you can claim the unpaid alimony from the estate of the deceased ex-spouse. You will need to file a creditor’s claim against the ex-spouse’s probate estate. This claim will allow you to receive the unpaid alimony from the estate.

How does the probate process work?

When the paying spouse dies, the state initiates the probate process to distribute the deceased person’s estate. The court appoints an administrator to oversee the distribution of assets and the payment of outstanding debts. As the recipient spouse, you can claim your unpaid alimony during this process by submitting a claim against the estate.

How can I secure spousal support before the paying spouse’s death?

To ensure the continuation of spousal support even after the paying spouse’s death, it is advisable to prepare a separation agreement that states the paying spouse is required to continue making spousal support payments even after their death by utilizing their estate. It is also possible to involve the court and obtain a court order that specifies the paying spouse’s liability for spousal support after death.

What are the different types of alimony?

Alimony can be categorized into different types, depending on the purpose and duration. Some common types of alimony include durational alimony, rehabilitative alimony, permanent alimony, and reimbursement alimony. Durational alimony lasts for a specific period of time, while rehabilitative alimony is intended to support the recipient spouse in obtaining education or skills necessary for self-sufficiency. Permanent alimony is for disabled or elderly spouses, and reimbursement alimony is for specific contributions made during the marriage.

How long does alimony last?

The duration of alimony payments can vary depending on factors such as the length of the marriage and the circumstances of the parties involved. Generally, alimony can be awarded for one-third to half the length of the marriage. Alimony can also be ordered to last for the recipient’s lifetime if they are elderly or disabled. Termination of alimony can occur if the recipient remarries or if either party passes away.

What factors are considered in determining the amount of alimony?

Courts consider various factors when determining the amount of alimony. These can include the financial need of the recipient spouse and the ability of the paying spouse to meet that need. Other factors can include the standard of living during the marriage, the earning capacities of both parties, their age, health, and contributions to the marriage.

Is alimony taxable?

Under the Tax Cuts and Jobs Act of 2017, alimony payments are no longer tax-deductible for the paying spouse and are no longer considered taxable income for the recipient. This change applies to divorces finalized in 2019 and after, as well as modifications made in 2019 or later to divorces that occurred before 2019.

How can I enforce an alimony award?

If your ex-spouse is not complying with court-ordered alimony payments, you can seek enforcement through contempt of court proceedings. This can result in a judgment for the amount due and potentially even jail time for the non-paying spouse. Other methods for enforcing alimony include income withholding and obtaining a writ of execution to seize the non-paying spouse’s assets.