Are you aware that the typical American typically retires at 62 years old and can anticipate spending around 18 years in retirement? This is quite a substantial amount of time to secure your financial stability. If you are considering gold as part of your retirement plan, it is crucial to comprehend the associated costs. This article offers a detailed look at the gold IRA costs, aiding you in planning your investment wisely and making informed choices regarding your precious metals investment.

Key Takeaways:

- Investing in gold can be a smart strategy for diversifying your retirement savings.

- Gold IRAs come with various costs, including setup fees, annual maintenance fees, storage fees, and transaction fees.

- It’s important to compare fee structures and choose a reputable gold IRA custodian to minimize costs.

- Consider the potential benefits of holding physical gold within a tax-advantaged account.

- Consult with a financial advisor to determine if a gold IRA aligns with your individual financial goals and risk tolerance.

What is a Gold IRA?

A gold IRA is a retirement account that allows you to invest in gold coins, bullion, and other precious metals as part of your retirement strategy. It is a specialized form of an individual retirement account (IRA) that must be held separately from traditional retirement accounts.

With a gold IRA, you can diversify your retirement portfolio and potentially benefit from the long-term value and stability of precious metals. It offers a unique opportunity to hold physical assets within a tax-advantaged account.

To set up a gold IRA, you can contribute with pretax or after-tax dollars through a custodian or broker. The Internal Revenue Service (IRS) permits self-directed IRA holders to purchase approved physical forms of gold, such as bars and coins, as well as gold-related securities.

“A gold IRA gives you the ability to protect your retirement savings with a tangible asset that has stood the test of time.” – Financial Expert

Investing in gold through a gold IRA can provide a hedge against inflation and economic uncertainty. Precious metals have a history of retaining value and may act as a safeguard in times of market volatility.

It’s important to understand that a gold IRA is not the same as owning physical gold outside of a retirement account. The gold held in a gold IRA is governed by specific IRS rules and must be stored in an approved depository or bank to comply with regulations.

Understanding Gold IRAs

Gold IRAs are a type of self-directed individual retirement account (IRA) that allows individuals to include physical gold and other precious metals as part of their retirement investment portfolio. These specialized IRAs offer the same tax advantages as traditional and Roth IRAs, but with the added benefit of holding physical assets. Unlike traditional IRAs that are limited to stocks, mutual funds, and other traditional investments, gold IRAs open up a world of opportunity for diversification.

To set up a gold IRA, you will need to work with a custodian such as a bank or brokerage firm to manage the account. The custodian will handle the necessary paperwork, administration, and reporting required by the IRS. They will also ensure that the gold is stored in an IRS-approved depository facility to comply with storage requirements.

Gold IRAs allow you to hold physical gold in the form of bars, coins, and other approved forms within your retirement account. However, they also offer the flexibility to invest in gold-related paper investments such as:

- Exchange-Traded Funds (ETFs): These are investment funds that trade on stock exchanges, tracking the price performance of gold.

- Stocks of Gold Mining Companies: Investing in the stocks of companies involved in gold mining can provide exposure to the gold industry.

- Precious Metals Mutual Funds: Mutual funds that focus on precious metals can offer diversified exposure to gold and other precious metals.

- Commodity Futures: Investors can trade futures contracts that derive their value from the price of gold.

By including these gold-related paper investments in your gold IRA, you can further diversify your portfolio and potentially maximize your returns.

“A gold IRA allows you to combine the tax advantages of a retirement account with the potential benefits of holding physical gold. It offers a unique opportunity for individuals seeking to safeguard their retirement savings and capitalize on the potential of the precious metals market.” – [Real name of an industry expert or reputable source]

Investing in a gold IRA can be a prudent strategy to protect your retirement savings and potentially benefit from the performance of precious metals. However, it is important to assess your investment goals, risk tolerance, and financial situation before making any investment decisions. Consulting with a financial advisor can help you determine if a gold IRA is suitable for your specific needs.

Next, we’ll explore the process of setting up a gold IRA and the various types of gold IRAs available to investors.

Setting Up a Gold IRA

When it comes to setting up a gold IRA, it’s important to work with a specialized gold IRA custodian who has experience in handling the necessary documentation and reporting for tax purposes. Traditional custodians typically don’t offer gold IRA accounts, so it’s crucial to find a custodian who specifically caters to this unique investment vehicle.

In order to contribute to a gold IRA, you must adhere to the contribution limits set by the IRS. For the year 2023, the contribution limit is $6,500, and it increases to $7,000 for 2024. It’s also worth noting that individuals who are 50 years or older can make an additional catch-up contribution of $1,000. By staying within these limits, you can ensure that your contributions remain compliant with IRS regulations.

When it comes to distributions from a gold IRA, they can be made penalty-free once you reach the age of 59½. However, if you make any withdrawals before this age, you may be subject to an additional 10% tax. It’s important to carefully consider the timing and amount of your distributions to avoid any unnecessary penalties.

To comply with storage requirements, gold held in a gold IRA must be stored in an IRS-approved facility. This means that you’ll need to choose a secure storage option such as a bank or depository that meets the necessary regulations. Storing your gold in an approved facility ensures that your investment remains safe and compliant with IRS guidelines.

Setting up a gold IRA requires working with a gold IRA custodian who specializes in this type of investment vehicle. By adhering to the IRS contribution limits, understanding the distribution rules, and storing your gold in an approved facility, you can ensure that your gold IRA is set up correctly and in compliance with all relevant regulations.

Types of Gold IRAs

When considering a gold IRA, there are different types to choose from, each with its own benefits and rules. Understanding the options available can help you make an informed decision. The three main types of gold IRAs are:

1. Traditional Gold IRA

A traditional gold IRA is funded with pretax dollars, allowing you to make contributions and let your earnings grow on a tax-deferred basis. This means you won’t have to pay taxes on your contributions or investment gains until you take distributions during retirement. This type of gold IRA is a popular choice for those who want to maximize their tax advantages.

2. Roth Gold IRA

A Roth gold IRA, on the other hand, is funded with after-tax money. This means you’ve already paid taxes on the contributions you make. The advantage of a Roth gold IRA is that when you take distributions at retirement, qualified distributions are tax-free. This can be beneficial if you expect your tax rate to be higher in retirement than it is now.

3. SEP Gold IRA

If you’re a small business owner or self-employed individual, you may be eligible for a SEP (Simplified Employee Pension) gold IRA. This type of gold IRA allows for tax-deductible contributions and tax-deferred growth. However, taxes are applied when you make withdrawals during retirement. SEP gold IRAs can be a valuable retirement savings option for those who are eligible.

Each type of gold IRA has its own contribution limits and rules set by the IRS. It’s important to consider your financial goals, tax situation, and eligibility when choosing the right type of gold IRA for your needs.

“By choosing the right type of gold IRA, you can enjoy the tax advantages and potential long-term growth of owning physical gold within a retirement account.”

| Gold IRA Type | Contributions | Distributions |

|---|---|---|

| Traditional Gold IRA | Pretax dollars | Taxed at retirement |

| Roth Gold IRA | After-tax dollars | Tax-free at retirement |

| SEP Gold IRA | Tax-deductible contributions | Taxed at retirement |

As you can see from the table, each type of gold IRA has its own unique tax treatment for contributions and distributions. Understanding these differences can help you determine which type aligns best with your financial goals and tax strategy.

Risks of Gold IRAs

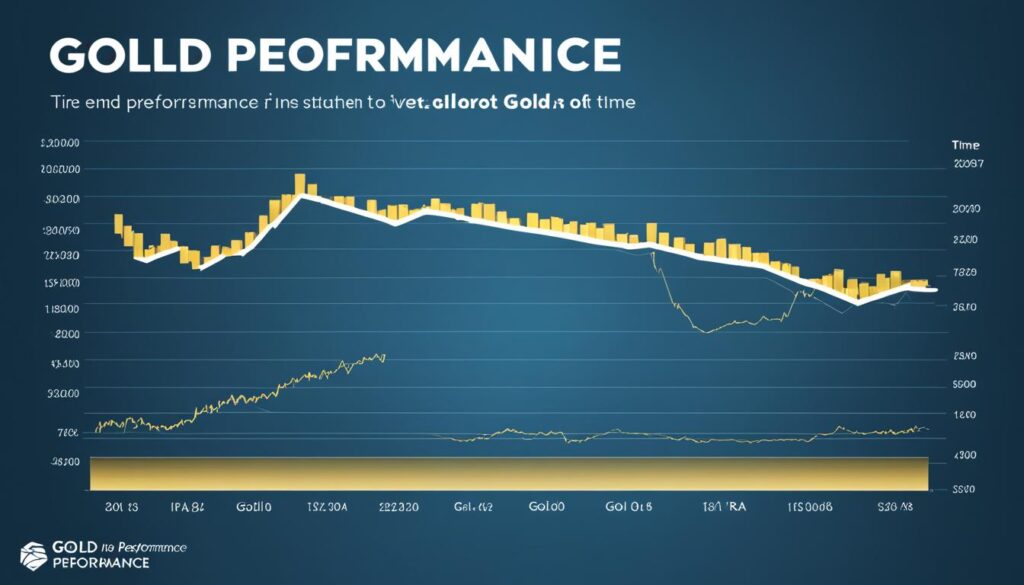

While investing in gold IRAs can be a valuable strategy to hedge against inflation and diversify your investment portfolio, it’s crucial to consider the risks involved. Gold has a strong track record of performing well during periods of financial uncertainty and market volatility, making it an attractive asset for many investors.

However, it’s important to note that gold IRA performance may not always align with the overall performance of the economy, especially during extended periods of economic growth. Gold prices can be influenced by various factors, including supply and demand dynamics, inflation rates, geopolitical tensions, and changes in investor sentiment.

Market volatility can also impact the value of your gold IRA. Fluctuations in the global economy, stock markets, and currency values can create price fluctuations in gold. While market volatility provides opportunities for potential gains, it can also result in temporary price declines.

“Gold holds its value in times of uncertainty and provides a safe haven for investors who want to protect their wealth. However, it’s important to remember that gold is not immune to market fluctuations.”

Therefore, before deciding to invest in a gold IRA, it is crucial to carefully assess your investment goals, risk tolerance, and time horizon. Consider consulting with a financial advisor who can provide expert guidance based on your individual circumstances.

Benefits of Gold IRAs as an Inflation Hedge

One of the key benefits of investing in a gold IRA is its potential to serve as an inflation hedge. Gold has historically been regarded as a store of value, maintaining its purchasing power over time. When inflation erodes the value of fiat currencies, gold can act as a hedge, preserving the real value of wealth.

During periods of high inflation, gold prices tend to rise as investors seek to protect their purchasing power. By including gold in your investment portfolio, you can potentially mitigate the negative effects of inflation and maintain the value of your retirement savings.

Gold IRA Performance and Diversification

In addition to its role as an inflation hedge, gold can also provide diversification benefits to your investment portfolio. Diversification involves spreading your investments across different asset classes to reduce risk.

Gold has historically exhibited low or negative correlations with other major asset classes, such as stocks and bonds. This means that when the value of stocks or bonds decreases, gold prices may increase or remain stable, providing a potential offset to losses in other areas of your portfolio.

The table below illustrates the average annual returns of gold, stocks, and bonds during periods of economic volatility:

| Year | Gold Return (%) | Stocks Return (%) | Bonds Return (%) |

|---|---|---|---|

| 2008 | -0.5 | -38.5 | 5.2 |

| 2002 | 24.5 | -14.6 | 10.3 |

| 2000 | 25.0 | -10.1 | 11.5 |

As seen in the table, gold has the potential to deliver positive returns during periods of economic downturns, offering a potential counterbalance to stock and bond investments.

In conclusion, while there are risks associated with investing in gold IRAs, the potential benefits, such as acting as an inflation hedge and diversifying your portfolio, make it an attractive option for many investors. By understanding the risks involved and conducting thorough research, you can make informed decisions that align with your investment goals and financial situation.

Are Gold IRAs a Good Idea?

If you’re looking to diversify your retirement savings and protect against certain financial factors, a gold IRA can be a beneficial investment. With a gold IRA, you have the opportunity to hold physical gold within a tax-advantaged account, providing potential benefits for your retirement strategy.

One of the main advantages of a gold IRA is diversification. By adding gold to your investment portfolio, you can reduce the risk associated with traditional assets like stocks and bonds. Gold has historically served as a hedge against inflation and economic uncertainty, making it a potentially valuable addition to your retirement savings.

Furthermore, a gold IRA provides you with the security of physically owning tangible assets. While traditional retirement accounts are typically invested in stocks, bonds, or mutual funds, a gold IRA allows you to own physical gold coins or bullion. This ownership can provide a sense of stability and control over your investments.

However, it’s important to keep in mind that gold IRAs should only make up a small portion of your overall investment portfolio. While gold can offer benefits, it’s crucial to maintain a balanced and diversified approach to investing. Consult with a financial advisor who specializes in retirement planning to determine if a gold IRA aligns with your individual financial goals and risk tolerance.

“With a gold IRA, you have the opportunity to hold physical gold within a tax-advantaged account, providing potential benefits for your retirement strategy.”

Benefits of Gold IRAs:

- Protection against inflation and economic uncertainty

- Diversification of investment portfolio

- Potential for long-term wealth preservation

Considerations:

- Gold IRAs should only make up a small portion of your overall portfolio

- Consult with a financial advisor before making investment decisions

| Gold IRA Benefits | Diversification | Retirement Savings |

|---|---|---|

| Protection against inflation and economic uncertainty | Reduces risk by adding a different asset class to your portfolio | Provides potential long-term wealth preservation |

| Opportunity to own physical gold within a tax-advantaged account | Offers a tangible and secure investment | May serve as a hedge against traditional assets |

| Diversifies your retirement savings strategy | Allows for greater control over your investments | Offers potential protection during economic downturns |

How Much Can You Put in a Gold IRA?

When it comes to contributing to a gold IRA, it’s important to understand the limits set by the IRS. These contribution limits determine the maximum amount you can put into your gold IRA account.

For the year 2023, the contribution limit is set at $6,500. This means that you can contribute up to $6,500 to your gold IRA account for that year. However, for the year 2024, the contribution limit increases to $7,000. So, starting in 2024, you’ll be able to contribute up to $7,000.

But what if you’re 50 years or older? Well, the IRS allows individuals who are 50 years or older to make additional catch-up contributions to their gold IRAs. You can contribute an extra $1,000 on top of the annual contribution limit. This means that for 2023, individuals who are 50 years or older can contribute up to $7,500, and for 2024, they can contribute up to $8,000.

It’s important to note that these contribution limits apply to both traditional and Roth IRAs, including gold IRAs. So whether you have a traditional gold IRA or a Roth gold IRA, the same contribution limits apply.

Contributing to a gold IRA allows you to take advantage of the tax benefits and potential growth that gold investments can offer. Just make sure to stay within the contribution limits set by the IRS to avoid any penalties or complications.

| Year | Contribution Limit | Catch-Up Contribution (50+) |

|---|---|---|

| 2023 | $6,500 | $1,000 |

| 2024 | $7,000 | $1,000 |

Can You Own Gold in an IRA?

In a gold IRA, you have the opportunity to own physical gold in the form of bars or coins. This allows you to diversify your investment portfolio with a tangible asset that has a long-standing reputation as a store of value. However, there are certain regulations and requirements set by the IRS that you need to follow.

The IRS requires that the gold held in a gold IRA meets specific standards, ensuring its purity and authenticity. To comply with these regulations, the gold must be held by the IRA trustee, which means it will be stored in an approved depository. These depositories are typically banks or other secure facilities that have been approved by the IRS as suitable storage locations for gold held in IRAs.

“In a gold IRA, you can own physical gold in the form of bars or coins. However, the gold needs to meet IRS standards and be held by the IRA trustee in an approved depository.”

Storing gold at home is not permitted within a gold IRA. The IRS imposes strict rules to ensure the security and integrity of the investment. If you were to store gold at home, it would be considered a distribution from the IRA, subjecting it to taxes and penalties.

By storing your gold in an approved depository, you can rest assured that it is being held in a secure and regulated environment. These depositories have extensive security measures in place to protect the gold and ensure its safekeeping.

It’s important to note that while you technically own the gold in a gold IRA, it is held on your behalf by the IRA trustee. This arrangement allows for the necessary oversight and compliance with IRS regulations.

Minimizing Gold IRA Fees

Investing in a gold IRA can be a smart financial move, but it’s important to be aware of the fees that come along with it. Understanding the various fee types and finding ways to minimize them can help you maximize your investment returns. Here are some strategies to help you minimize gold IRA fees:

Compare Fee Structures

When choosing a custodian for your gold IRA, it’s essential to compare the fee structures of different providers. Look for custodians that offer competitive rates and transparent fee schedules. By carefully reviewing and comparing fee structures, you can find a custodian that charges reasonable fees for their services.

Negotiate Fees

Don’t be afraid to negotiate fees with your chosen custodian. In many cases, custodians are willing to work with you to find a fee arrangement that suits your needs. Be prepared to have a conversation about your investment goals and the value you expect from the services provided. Negotiating fees can help you secure a more favorable arrangement and potentially reduce your overall costs.

Choose Low-Cost Storage Options

Gold IRA storage fees can vary depending on the type of storage option you choose. While segregated storage is typically considered the safest option, it can come with higher fees. Consider opting for commingled storage, where multiple investors’ holdings are stored together. Commingled storage can be a lower-cost alternative while still providing the security and integrity required for your gold investments.

Avoiding unnecessary transaction fees is also crucial for minimizing costs. Ensure you understand the fee structure for buying and selling gold within your IRA and look for custodians that offer low or zero transaction fees.

Review the Fee Schedule

Before making any investment decisions, carefully review the fee schedule provided by your chosen custodian. By understanding the costs associated with a gold IRA, you can make informed investment decisions that align with your financial goals. Take note of setup fees, annual maintenance fees, gold storage fees, transaction fees, and any other miscellaneous fees that may apply.

Remember, minimizing fees doesn’t mean compromising on quality or security. It’s about finding the right balance between cost and value. By doing your research, comparing fee structures, and negotiating with custodians, you can minimize gold IRA fees and optimize your investment returns.

Now that you have a better understanding of how to minimize gold IRA fees, let’s take a closer look at some of the additional costs and hidden fees that you should be aware of. These fees can impact your overall investment performance and should be considered when planning your gold IRA.

Hidden Fees and Additional Costs of Gold IRAs

While considering a gold IRA for your retirement investment, it is essential to be aware of the potential hidden fees and additional costs that may be associated with this type of account. In addition to the standard fees such as setup fees, annual maintenance fees, and storage fees, there are other expenses that you should take into account.

Insurance fees are one such cost that you may encounter when investing in a gold IRA. These fees cover the insurance of the physical gold held in your account, ensuring its protection and providing you with added peace of mind.

Audit fees are another consideration. Periodic metal audits may be conducted to verify the existence and purity of the gold held in your account. These audits help maintain the integrity of your investment but may come with associated fees.

For quick fund transfers into or out of your gold IRA, wire transfer fees may apply. These fees are typically charged by the custodian or financial institution facilitating the transfer and can vary depending on the provider and the transaction amount.

It is important to carefully review the fee schedule and terms of your chosen gold IRA provider to be aware of any potential additional costs. Some providers may have miscellaneous fees or additional charges depending on the service package you select.

Example Table: Common Hidden Fees and Costs of Gold IRAs

| Fee Type | Description |

|---|---|

| Insurance Fees | Fees for insuring the stored gold in your account |

| Audit Fees | Fees for periodic metal audits to ensure the integrity of your gold investment |

| Wire Transfer Fees | Fees for quick fund transfers into or out of your gold IRA |

| Other Miscellaneous Fees | Potential additional fees depending on the service package and provider |

By being aware of and accounting for these hidden fees and additional costs, you can better prepare and make informed decisions regarding your gold IRA investment. It is recommended to evaluate different providers, compare their fee structures and service offerings, and choose a trusted custodian that aligns with your investment goals and financial situation.

Conclusion

In conclusion, gold IRAs provide investors with an attractive option to hold physical gold within a tax-advantaged retirement account. While there are fees and expenses associated with gold IRAs, understanding the costs involved can help you make informed investment decisions. It’s important to consider factors such as setup fees, annual maintenance fees, storage fees, transaction fees, and other miscellaneous costs when planning your gold IRA.

By minimizing fees and choosing a reputable custodian, you can optimize your gold IRA investments and potentially benefit from diversification and a hedge against inflation. Remember to compare fee structures from different custodians and negotiate fees whenever possible. Additionally, selecting low-cost storage options can help reduce expenses. Consult with a financial advisor to determine if a gold IRA is a suitable investment option for you based on your individual financial goals and risk tolerance.

With careful planning and consideration, a gold IRA can be a valuable addition to your retirement savings portfolio. Take the time to understand the costs, choose a reliable custodian, and make informed investment decisions to make the most of this opportunity to hold physical gold within a tax-advantaged account.

FAQ

What are the costs associated with a gold IRA?

How can I minimize the fees of a gold IRA?

Are there any hidden fees or additional costs to consider with a gold IRA?

What is a gold IRA?

How much can I contribute to a gold IRA?

Is It Worth Investing in a Gold IRA During the Divorce Process in Ohio?

If you are getting a divorce in Ohio, investing in a Gold IRA can be a wise decision to protect your assets. Gold has historically been a safe haven during times of economic uncertainty. By converting a portion of your IRA into gold, you can safeguard your wealth during the divorce process.

FAQ

What are the costs associated with a gold IRA?

Gold IRAs come with various fees, including setup fees, annual maintenance fees, gold storage fees, transaction fees, and other miscellaneous fees. It is important to review the fee schedule and understand the costs associated with a gold IRA before making any investment decisions.

How can I minimize the fees of a gold IRA?

To minimize fees, individuals can compare fee structures from different gold IRA custodians and negotiate fees with their chosen provider. Choosing low-cost storage options, such as commingled storage instead of segregated storage, can also help reduce fees.

Are there any hidden fees or additional costs to consider with a gold IRA?

In addition to the standard fees, there may be hidden fees and additional costs to consider, such as insurance fees, audit fees, wire transfer fees, and others. Investors should carefully review the fee schedule and terms of their chosen gold IRA provider to be aware of any potential additional costs.

What is a gold IRA?

A gold IRA is a specialized individual retirement account (IRA) that allows investors to hold physical gold as a qualified retirement investment. It is a retirement account that provides the opportunity to hold physical gold within a tax-advantaged account.

How much can I contribute to a gold IRA?

The maximum amount an individual can contribute to a gold IRA is determined by the IRS. For 2023, the contribution limit is set at ,500, and for 2024, it increases to ,000. Individuals who are 50 years or older can make catch-up contributions of an additional

FAQ

What are the costs associated with a gold IRA?

Gold IRAs come with various fees, including setup fees, annual maintenance fees, gold storage fees, transaction fees, and other miscellaneous fees. It is important to review the fee schedule and understand the costs associated with a gold IRA before making any investment decisions.

How can I minimize the fees of a gold IRA?

To minimize fees, individuals can compare fee structures from different gold IRA custodians and negotiate fees with their chosen provider. Choosing low-cost storage options, such as commingled storage instead of segregated storage, can also help reduce fees.

Are there any hidden fees or additional costs to consider with a gold IRA?

In addition to the standard fees, there may be hidden fees and additional costs to consider, such as insurance fees, audit fees, wire transfer fees, and others. Investors should carefully review the fee schedule and terms of their chosen gold IRA provider to be aware of any potential additional costs.

What is a gold IRA?

A gold IRA is a specialized individual retirement account (IRA) that allows investors to hold physical gold as a qualified retirement investment. It is a retirement account that provides the opportunity to hold physical gold within a tax-advantaged account.

How much can I contribute to a gold IRA?

The maximum amount an individual can contribute to a gold IRA is determined by the IRS. For 2023, the contribution limit is set at $6,500, and for 2024, it increases to $7,000. Individuals who are 50 years or older can make catch-up contributions of an additional $1,000.

Can I own physical gold in a gold IRA?

Yes, in a gold IRA, individuals can own physical gold in the form of bars or coins. However, the gold must meet IRS standards and be held by the IRA trustee, not the IRA owner. The gold must be stored in an approved depository, such as a bank or other secure facility.

What are the different types of gold IRAs?

There are different types of gold IRAs, including traditional gold IRAs, Roth gold IRAs, and SEP gold IRAs. Each type has its own contribution limits and rules set by the IRS.

What are the risks of investing in a gold IRA?

While gold IRAs can be an effective strategy to hedge against inflation and diversify investment portfolios, it is important to consider the risks involved. Gold may not always match the returns of the overall economy, especially during extended periods of economic growth.

Are gold IRAs a good investment?

Gold IRAs can be a good idea for individuals who want to diversify their retirement savings and hedge against certain financial factors. However, it is recommended to consult with a financial advisor to determine if a gold IRA is a suitable investment option based on individual financial goals and risk tolerance.

What are the distribution rules for a gold IRA?

Distributions from a gold IRA can be made penalty-free after the age of 59½, and any withdrawals made before that age are subject to a 10% extra tax. It is important to understand the distribution rules and tax implications before making any withdrawals from a gold IRA.

Can I store gold for a gold IRA at home?

No, to comply with IRS regulations, the gold held in a gold IRA must be stored in an approved depository, such as a bank or other secure facility. Storing gold at home is not permitted and can result in taxes and penalties.

Can I own physical gold in a gold IRA?

Yes, in a gold IRA, individuals can own physical gold in the form of bars or coins. However, the gold must meet IRS standards and be held by the IRA trustee, not the IRA owner. The gold must be stored in an approved depository, such as a bank or other secure facility.

What are the different types of gold IRAs?

There are different types of gold IRAs, including traditional gold IRAs, Roth gold IRAs, and SEP gold IRAs. Each type has its own contribution limits and rules set by the IRS.

What are the risks of investing in a gold IRA?

While gold IRAs can be an effective strategy to hedge against inflation and diversify investment portfolios, it is important to consider the risks involved. Gold may not always match the returns of the overall economy, especially during extended periods of economic growth.

Are gold IRAs a good investment?

Gold IRAs can be a good idea for individuals who want to diversify their retirement savings and hedge against certain financial factors. However, it is recommended to consult with a financial advisor to determine if a gold IRA is a suitable investment option based on individual financial goals and risk tolerance.

What are the distribution rules for a gold IRA?

Distributions from a gold IRA can be made penalty-free after the age of 59½, and any withdrawals made before that age are subject to a 10% extra tax. It is important to understand the distribution rules and tax implications before making any withdrawals from a gold IRA.

Can I store gold for a gold IRA at home?

No, to comply with IRS regulations, the gold held in a gold IRA must be stored in an approved depository, such as a bank or other secure facility. Storing gold at home is not permitted and can result in taxes and penalties.