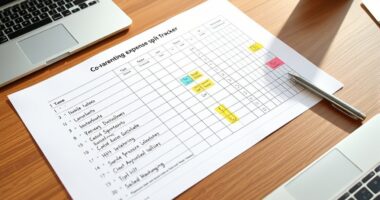

A child expense tracking worksheet for co-parents helps you organize and share all costs related to your child’s needs, such as medical, educational, and transportation expenses. It promotes transparency, simplifies payment tracking, and reduces disagreements by keeping a clear record of dates, amounts, and reimbursements. You can customize it to fit your agreement and verify both parents stay informed. If you want to learn how to set one up effectively, there’s more to explore below.

Key Takeaways

- Provides a shared platform for co-parents to record, monitor, and manage child-related expenses transparently.

- Customizable categories, child details, and automatic calculations ensure accurate expense division.

- Secure sharing options, including password protection and real-time updates, maintain confidentiality and collaboration.

- Regular expense entries and review sessions promote timely reconciliation and reduce potential conflicts.

- Supports multiple formats like Google Sheets, Excel, or apps to suit different preferences and needs.

Managing child-related expenses can be challenging for co-parents without clear records. A child expense tracking worksheet helps you keep everything organized and transparent, making it easier to manage shared costs. When both parents have access to a straightforward record, misunderstandings and conflicts decrease. You can see exactly what has been paid, what’s pending, and how expenses are divided, fostering trust and clarity in your co-parenting arrangement. These worksheets serve as a central hub, where due dates, payment statuses, and total amounts owed are all consolidated, so you don’t have to sift through multiple emails or receipts. Having a clear view of past and current expenses also makes it easier to monitor child support payments, ensuring they’re made on time and that shared costs are balanced fairly. Additionally, understanding the importance of affiliate disclosures ensures transparency when sharing links or resources related to these tools.

A child expense tracker promotes transparency, reduces conflicts, and simplifies sharing costs for co-parents.

An effective child expense tracking worksheet offers features that support customization and accuracy. You can tailor it to include your and your co-parent’s names, specific expense categories, and the names of your children. This flexibility helps you categorize costs like basic needs—food, clothing, housing—medical expenses, educational costs, childcare fees, and transportation costs related to child exchanges or activities. Many templates include a transaction ledger that automatically calculates each parent’s share and reimbursement balances, reducing manual errors. Reporting tools can break down expenses by child, category, or timeframe, giving you better financial oversight and helping you prepare for future expenses or disputes.

Security measures are crucial. Look for worksheets with locked cells or password protection to ensure your data stays confidential and unaltered by mistake. Many platforms support sharing or integration, allowing both parents to update expenses in real time, which keeps everyone on the same page. You can choose formats based on your preferences: Google Sheets for free online collaboration, Excel templates for offline use, printable logs for manual tracking, or dedicated apps that offer receipt uploads and payment management. Online planners like Notion also let you track alimony, visits, and health expenses in one place.

Using a child expense worksheet effectively involves prompt entry of costs, detailed descriptions, and attaching receipts when possible. Clearly agree on expense categories and how costs are split to avoid confusion later. Shared access ensures both parents stay updated, and regular review sessions help you reconcile expenses early, preventing disputes. Maintaining version histories and locking cells protect your data from accidental changes. With these tools and practices, managing child-related expenses becomes less stressful, more transparent, and fair for everyone involved.

Frequently Asked Questions

How Do I Handle Unexpected Child-Related Expenses?

When unexpected child-related expenses come up, you should first review your budget and emergency fund to cover the costs. Communicate openly with the other parent about the expense and agree on how to split it, whether equally or proportionally. Keep receipts, document the expense, and update your tracking worksheet. Consider using flexible spending accounts or community resources to help manage sudden costs without disrupting your finances.

Can the Worksheet Accommodate Multiple Children?

Did you know that nearly 60% of co-parents find tracking expenses for multiple children challenging? The worksheet can handle multiple children, but you’ll need to customize it. You might duplicate sheets or add categories for each child, as most templates don’t natively support multiple profiles. Stay organized by naming sections clearly, regularly reconciling expenses, and using filters to generate child-specific reports, minimizing errors and ensuring fairness.

How Often Should Co-Parents Update the Worksheet?

You should update the worksheet immediately after incurring any shared expenses to keep records accurate. Additionally, setting a regular schedule, like weekly or biweekly updates, helps make certain everything stays current and transparent. Update whenever you request reimbursements or around parenting plan review dates. Consistent updates reduce misunderstandings, promote fairness, and make it easier to track expenses, reimbursements, and prepare for any legal or financial adjustments.

What if One Parent Disputes an Expense?

Imagine holding a clear, detailed receipt in your hand, ready to clarify any confusion. If one parent disputes an expense, stay calm and review your records together. Share documentation like receipts or emails to support your claim. Open communication helps. If you can’t resolve it, consider mediation or involving a neutral third party. Staying organized and transparent guarantees you handle disputes efficiently, keeping your co-parenting relationship cooperative and focused on your child’s needs.

Are There Digital Tools to Automate This Tracking?

Yes, numerous digital tools automate child expense tracking for co-parents. Apps like OurFamilyWizard, 2Houses, and Custody X Change let you upload receipts, split expenses automatically, and generate detailed reports. These platforms also sync with messaging and calendars, making coordination easier. They reduce manual work, minimize errors, and provide secure, timestamped records—perfect for resolving disputes, streamlining reimbursements, and keeping everything transparent and organized for both parents.

Conclusion

Using a child expense tracking worksheet can save you time and reduce disagreements with co-parents. Did you know that 65% of co-parents report improved communication when they keep detailed expense records? By staying organized and transparent, you’ll guarantee both parents are on the same page, making co-parenting smoother. Start using a worksheet today to simplify your financial sharing—your child’s well-being and your peace of mind will thank you!