Financial Aspects

How to Set a Financial Settlement Time Limit After Divorce

Are you curious about the consequences of not setting a financial settlement time limit after divorce? Discover the intricate process and essential factors to consider.

Let’s begin with this thought: have you ever pondered the possible repercussions of failing to set a deadline for a financial settlement after a divorce?

The process of setting such a boundary can be intricate, but it is essential for ensuring a clear and defined path forward for both parties involved.

By exploring the various factors that come into play when determining these limits, we can gain valuable insights into how to navigate this aspect of post-divorce financial management successfully.

Key Takeaways

- Establishing time limits is crucial for timely resolution and closure.

- Factors like family dynamics and legal requirements inform time limits.

- Consult with a family lawyer to draft clear agreements.

- Utilize communication strategies for mutual understanding and successful negotiation.

Importance of Setting Time Limits

Setting a financial settlement time limit after divorce is crucial for ensuring a timely resolution of financial matters and preventing potential future disputes. In property settlement proceedings, establishing a specific timeframe within which financial matters must be settled helps in avoiding prolonged uncertainty and ongoing legal battles. Without a set time limit, ex-spouses may delay negotiations or seek to reopen financial settlements, leading to extended legal disputes and financial instability.

By imposing a time limit, both parties are encouraged to engage in timely negotiations, facilitating a quicker resolution and enabling individuals to move forward with their financial plans post-divorce. This structured approach promotes closure, minimizes the risk of future claims, and allows for a smoother transition into the next chapter of each person's life.

Ultimately, setting a time limit for financial settlement post-divorce is essential in providing clarity, certainty, and a sense of finality to all parties involved.

Factors to Consider in Setting Limits

Considering the importance of timely resolution in financial matters post-divorce, it becomes imperative to assess various factors that play a significant role in determining the appropriate limits for settlement.

Firstly, the complexity of family dynamics and the intricacies of property settlement must be taken into account. Each family's situation is unique, requiring a tailored approach to establish a reasonable timeframe.

Secondly, the legal requirements for the application for property settlement should guide the decision-making process. Understanding the specific deadlines and procedures involved in property settlement applications is crucial to avoid unnecessary delays.

Additionally, the potential implications of missing the statutory time limit of 12 months after divorce for financial settlements shouldn't be underestimated. Delays can jeopardize property division rights and may impact spousal maintenance entitlements.

Seeking legal advice early on can provide clarity on these matters and help protect one's financial interests during the settlement process.

Steps to Establish a Time Limit

When establishing a time limit for reaching a financial settlement after divorce, it is crucial to carefully consider the personal circumstances and agreements to determine the desired timeframe. Consulting with a family lawyer specializing in family law can provide valuable insights into the legal requirements and options available for setting a time limit for the financial settlement. Factors such as asset division, spousal maintenance, child support, and other financial obligations should all be taken into account when establishing the time limit to ensure a fair and equitable outcome. One effective way to formalize the agreed-upon time frame is by drafting a formal agreement or consent order that explicitly states the deadline for completing the financial settlement post-divorce. This document becomes legally binding and can help prevent misunderstandings or disputes in the future. It is essential to ensure clarity and mutual understanding between parties regarding the consequences of not meeting the set time limit for financial settlement.

| Family Law ConsultationLegal Requirements for Time LimitDraft Formal Agreement | ||

|---|---|---|

| Consider Personal Circumstances | Asset Division and Financial Obligations | Ensure Clarity and Understanding |

| Consult with Family Lawyer | Spousal Maintenance and Child Support | Prevent Disputes and Misunderstandings |

Communication Strategies for Agreement

Effective communication strategies play a vital role in facilitating agreement on financial matters during the divorce settlement process. Parties involved in a divorce can benefit significantly from clear and concise discussions regarding their financial settlement agreement.

Seeking professional mediation services can provide a structured environment for constructive dialogue and help navigate complex financial issues efficiently. Utilizing written proposals and documentation can assist in clarifying terms and ensuring mutual understanding between both parties.

Regular updates and follow-ups on negotiations are essential to maintain momentum towards reaching a timely financial settlement.

Consequences of Not Setting a Time Limit

Failing to establish a time limit for financial settlement post-divorce can result in prolonged uncertainty and potential financial risks, leading to disputes over assets, liabilities, and ongoing financial responsibilities. Without a clear deadline, ex-spouses may procrastinate or avoid finalizing the financial aspects of their divorce, which can lead to increased stress and legal complications. This lack of clarity can also impact financial planning, property division, and overall stability after divorce. Moreover, not setting a time limit can hinder the closure needed to move forward with financial independence. To illustrate the consequences further, consider the following table:

| Consequences of Not Setting a Time Limit | ||

|---|---|---|

| Prolonged Uncertainty | Potential Financial Risks | Disputes Over Assets |

| Disputes Over Liabilities | Ongoing Financial Responsibilities |

In essence, failing to establish a time limit for financial settlement post-divorce can have detrimental effects on both parties, potentially leading to court involvement and prolonged legal proceedings.

Frequently Asked Questions

Who Is Better off Financially After Divorce?

After divorce, financial outcomes vary depending on factors like earning potential, assets, and agreements made during marriage. The spouse with higher income or assets may fare better financially. Seeking legal advice is vital for a fair settlement.

How Do I Manage My Finances After Divorce?

After divorce, we manage finances by creating a budget, seeking financial advice, updating accounts, understanding obligations, and keeping records. These steps ensure financial stability and legal compliance. It's crucial to stay organized and proactive in managing post-divorce finances.

Is There a Statute of Limitations on Divorce Settlements in Texas?

In Texas, no specific statute of limitations for divorce settlements exists. Parties can negotiate financial matters post-divorce without time constraints. If no agreement is reached, court intervention may be needed. Seeking legal advice is recommended.

Can Ex Wife Claim Inheritance After Divorce?

We can't predict if your ex-wife can claim inheritance post-divorce. Legal advice is crucial. Inheritance's treatment varies. Seek guidance from a family lawyer. Understand the nuances. Protect your assets. Your future matters.

What is the Process for Setting a Time Limit for Financial Settlement After Divorce?

When going through a divorce, it’s essential to adhere to financial settlement time limits. The process for setting a time limit for financial settlement after divorce involves legally filing for the settlement within the specified timeframe. It’s crucial to consult with a lawyer to ensure all deadlines are met.

Conclusion

In conclusion, it's essential to set a financial settlement time limit after divorce to avoid future complications and protect your assets.

For example, a couple who didn't establish a time limit faced a legal battle years later when one party tried to claim a portion of the other's inheritance.

By proactively setting a time limit and resolving financial issues promptly, you can ensure a smoother transition post-divorce and safeguard your financial interests.

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Financial Aspects

Navigating Financial Disclosure in Divorce Cases

Are you aware that sharing financial information is a crucial aspect of the divorce process? It is more than just dividing assets and debts; it is about ensuring transparency and fairness in the agreement. Without sufficient financial disclosure, the entire process could go awry and lead to unfavorable results.

When going through a divorce, disclosing financial details is necessary to make informed decisions and reach a fair resolution. By sharing comprehensive information about your assets, debts, income, and expenses, both spouses can evaluate the financial situation and negotiate a settlement that takes into account their respective needs.

In this article, we will explore the importance of financial disclosure in divorce, the deadlines for sharing financial information, how to gather the necessary documents, filling out the required forms, and the consequences of incomplete or dishonest disclosures. We will also provide tips for a smooth disclosure process and highlight the benefits of seeking professional guidance. Stay tuned to learn more about navigating financial disclosure in divorce cases.

Key Takeaways

- Sharing financial information is crucial in divorce cases to ensure transparency and fairness in the settlement.

- Proper financial disclosure helps both spouses make informed decisions regarding assets, debts, income, and expenses.

- There are specific deadlines for sharing financial information based on your role in the divorce.

- Gathering the necessary financial documents is essential for an accurate and transparent disclosure process.

- Filling out the required forms accurately and honestly is crucial to avoid penalties and legal consequences.

The Importance of Financial Disclosure in Divorce

Sharing financial information is essential in the divorce process. It allows both parties to make informed decisions regarding property division, spousal support, and other financial matters. By disclosing comprehensive details about assets, debts, income, and expenses, spouses can evaluate the financial situation and negotiate a fair settlement.

Financial transparency in divorce promotes fairness, efficiency, and credibility. It ensures that both spouses have equal access to financial information, allowing them to advocate for their interests effectively. Without financial disclosure, one party may have an advantage, leading to an imbalanced outcome.

Disclosing finances also helps in determining the true value of marital assets. By sharing financial information, hidden assets or debts can be uncovered, preventing one spouse from hiding or undervaluing their financial worth. This transparency encourages honesty and accountability throughout the divorce process.

Furthermore, financial disclosure fosters trust between the parties involved. When both spouses are open and forthcoming about their financial situations, it creates a foundation of trust, which is crucial for reaching a fair and equitable settlement. Trust facilitates effective communication and negotiations, facilitating a smoother transition into post-divorce life.

“Financial transparency is not only a legal obligation but also a moral commitment in divorce. By sharing financial information, both parties can navigate the divorce process with transparency and integrity, ensuring a fair and just outcome.

Ultimately, the importance of sharing financial information in divorce cannot be overstated. It enables spouses to make informed decisions, promotes fairness and credibility, uncovers hidden assets or debts, and fosters trust. Financial transparency paves the way for a smoother divorce process, providing a solid foundation for building a new future.

| Benefits of Disclosing Finances in Divorce |

|---|

| Facilitates fair and equitable division of property and assets. |

| Promotes efficiency and credibility in the divorce process. |

| Uncovers hidden assets or debts, preventing unfair advantages. |

| Fosters trust and open communication between spouses. |

Deadlines for Sharing Financial Information

When going through a divorce, it is crucial to understand the deadlines for sharing financial information. These deadlines vary depending on your role in the divorce proceedings. As the petitioner, the spouse who initiated the divorce, you are responsible for filing the Petition and disclosing your financial information within 60 days after filing. On the other hand, as the respondent, you have 60 days after filing the Response to share your financial information.

Adhering to these deadlines is essential to ensure a smooth and efficient divorce process. Failing to meet the disclosure deadlines can result in delays, complications, and potential penalties. Therefore, it is important to be aware of the specific timeframe and prioritize the timely exchange of financial information.

By respecting the deadlines for sharing financial information, both parties can move forward in the divorce process with transparency and a clear understanding of each other’s financial situations. This allows for informed decision-making regarding property division, spousal support, and other related matters.

Remember, failing to meet these disclosure deadlines can have significant consequences on the divorce process. It is in your best interest to comply with the required timelines and ensure a fair and equitable resolution.

Seeking professional guidance, such as consulting with a divorce attorney or financial advisor, can provide valuable assistance in navigating the complexities of financial disclosure. These experts can offer personalized advice based on your specific circumstances, ensuring compliance with legal requirements and maximizing your understanding of the disclosure process.

Gathering Financial Documents for Disclosure

To support your disclosure of financial information in a divorce, it is crucial to gather the necessary documents. These documents play a vital role in ensuring accuracy and transparency in the disclosure process. By collecting the following financial records, you can provide a comprehensive overview of your financial situation:

- Tax returns from the past two years

- Proof of income for the last two months, such as pay stubs

- Documents outlining your assets and debts

- Mortgage statements

- Bank account statements

- Credit card statements

- Retirement account statements

Gathering these documents will provide a comprehensive view of your financial status, allowing both parties involved in the divorce to make informed decisions regarding property division, spousal support, and other financial matters.

| Documents Required for Financial Disclosure | Why They Are Important |

|---|---|

| Tax returns from the past two years | Provide an overview of your income, deductions, and financial history. |

| Proof of income for the last two months | Shows your current earning capacity and helps determine support obligations. |

| Documents outlining assets and debts | Includes a detailed list of what you own and what you owe. |

| Mortgage statements | Provide information about any outstanding mortgage debts. |

| Bank account statements | Reveal your financial transactions, including deposits, withdrawals, and account balances. |

| Credit card statements | Show your credit card transactions and outstanding balances. |

| Retirement account statements | Provide details about your pension, 401(k), or other retirement accounts. |

Gathering these necessary documents will streamline the disclosure process and ensure that all relevant financial information is presented accurately and transparently.

Filling Out the Required Forms for Disclosure

Once you have gathered all the necessary financial documents, you will need to fill out three forms:

1. Declaration of Disclosure (Form FL-140)

The Declaration of Disclosure is a crucial form that provides a comprehensive overview of your financial situation in the divorce process. It requires you to disclose information about your assets, debts, income, and expenses. This form helps ensure transparency and fairness during property division and support negotiations.

2. Income and Expense Declaration (Form FL-150)

The Income and Expense Declaration form requires you to provide detailed information about your monthly income and expenses. This information helps determine alimony, child support, and other financial obligations. Make sure to accurately and honestly report your financial details to avoid any legal consequences.

3. Schedule of Assets and Debts (Form FL-142) or Property Declaration (Form FL-160)

The Schedule of Assets and Debts or Property Declaration form requires you to list all your assets and debts, including real estate, bank accounts, investments, vehicles, and liabilities. This comprehensive inventory helps establish a fair division of marital property. Ensure you provide accurate information to maintain transparency and credibility throughout the divorce proceedings.

These forms play a vital role in the financial disclosure process, providing the necessary information for a fair settlement. It is crucial to complete them truthfully and accurately, as the court relies on this information to make informed decisions.

Form Name Purpose Declaration of Disclosure (Form FL-140) Provides a comprehensive overview of your financial situation, including assets, debts, income, and expenses. Income and Expense Declaration (Form FL-150) Requires detailed information about your monthly income and expenses, aiding in determining financial obligations. Schedule of Assets and Debts (Form FL-142) or Property Declaration (Form FL-160) Lists all assets and debts, facilitating a fair division of marital property.

Filling out these forms accurately and honestly is essential to avoid potential penalties and ensure a fair resolution. Take the time to carefully review and complete each form, seeking professional guidance if needed. Remember, financial disclosure is a necessary step towards achieving a fair and equitable divorce settlement.

Making Copies and Sending Documents to Your Spouse

Once you have completed the necessary forms and attached all the required documents, it is crucial to make copies of everything for your spouse. These copies should not be filed with the court but should be sent to your spouse for their review. Remember, maintaining transparency and open communication throughout the divorce process is essential.

“Sharing financial information is a crucial step in the divorce process. By making copies of your disclosure documents, you provide your spouse with the opportunity to review and assess the information independently. This promotes trust and fairness, setting the stage for productive negotiations.”

By sending the copies of the disclosure documents, you allow your spouse to examine the information and ask any necessary questions. It is recommended to utilize a secure and traceable method of sending, such as certified mail or email with read receipts, to ensure that the documents reach your spouse safely and can be verified if needed.

As you send the copies of the documents, it is important to retain the original set in a secure place. Keeping the originals will ensure that you have access to all necessary information in case any questions or disputes arise in the future.

Remember, honesty and transparency in sharing financial information can contribute to a smoother divorce process and facilitate negotiations for a fair settlement.

| Steps for Making Copies and Sending Documents to Your Spouse | Benefits |

|---|---|

| 1. Make copies of all completed forms and attached documents. | Ensures that both parties have access to the same information. |

| 2. Send the copies to your spouse via a secure and traceable method. | Allows your spouse to review the information independently. |

| 3. Retain the original set of documents in a safe place. | Provides a backup in case of questions or disputes in the future. |

Consequences of Incomplete or Dishonest Financial Disclosures

Failure to provide accurate and complete financial information in a divorce can have serious repercussions. It can result in penalties, legal consequences, and negative impacts on the divorce process itself.

1. Penalties for hiding financial information in divorce:

- Being held in contempt of court: Intentionally hiding or withholding financial information can be seen as contempt of court, which may result in fines or even imprisonment.

- Monetary sanctions: The court may impose monetary sanctions as a punishment for concealing financial information or providing false statements.

- Asset allocation to the other spouse: If it is discovered that one party has hidden assets or income, the court may award those assets to the innocent spouse as compensation.

2. Consequences of false financial disclosure:

- Setting aside agreements or decisions: If false financial information significantly affects a court’s decision on property division or spousal support, the court may set aside those agreements or decisions.

- Legal and financial setbacks: Providing false financial information can lead to delays in the divorce process, increased legal fees, and loss of credibility in court.

3. Legal repercussions for incomplete disclosure:

- Delayed or extended divorce process: Incomplete financial disclosure can cause delays as the court may require additional time to review the incomplete information or request further documentation.

- Inaccurate settlement agreements: Incomplete disclosure can result in settlement agreements that do not accurately reflect the financial situation, leading to unfair outcomes for one or both parties.

- Emotional strain and mistrust: Incomplete or dishonest financial disclosure can erode trust between the parties and create unnecessary emotional strain during an already difficult process.

To ensure a fair and smooth divorce process, it is crucial to be transparent and provide accurate and complete financial information. Seeking legal advice and guidance from a divorce attorney can help navigate the complexities of financial disclosure and avoid the severe consequences associated with incomplete or dishonest disclosures.

Tips for a Smooth Financial Disclosure Process

When going through a divorce, ensuring transparency and sharing financial information is crucial for a fair and amicable settlement. To facilitate a smooth financial disclosure process, consider the following best practices:

- Prioritize the Task: Make disclosing financial information a priority and allocate sufficient time and resources to gather all the necessary documents and complete the required forms accurately.

- Gather all Necessary Documents: Collecting relevant financial records is essential for a comprehensive disclosure. This includes tax returns, proof of income, asset and debt statements, bank and credit card statements, and retirement account details. Organize these documents to ensure accuracy and efficiency during the disclosure process.

- Fill Out Forms Accurately and Honestly: When completing the required forms, such as the Declaration of Disclosure, Income and Expense Declaration, and Schedule of Assets and Debts, provide accurate and honest information. This is crucial for building credibility and avoiding potential penalties or disputes.

- Make Copies of Everything: After filling out the forms and attaching the necessary documents, make copies of everything. These copies should be sent to your spouse for review, while the original set of forms and attachments should be kept securely.

- Send Copies to Your Spouse: Share the copies of the financial disclosure with your spouse, emphasizing the importance of their review and understanding. Open communication during this stage can facilitate negotiation and ensure transparency.

Example Table: Financial Documents Checklist

| Document | Description |

|---|---|

| Tax Returns | Income tax returns from the past two years |

| Proof of Income | Pay stubs or other documents demonstrating income for the last two months |

| Asset Statements | Statements for bank accounts, investment accounts, real estate, and other assets |

| Debt Statements | Statements for mortgages, credit cards, loans, and other debts |

| Retirement Account Details | Statements and documents related to retirement accounts, such as 401(k)s or pension plans |

Transparent financial disclosure is the foundation of a fair divorce settlement. By following these tips, couples can navigate the process smoothly, minimizing disputes and achieving a mutually beneficial outcome.”

By following these tips for sharing finances in divorce, individuals can ensure transparency, accuracy, and efficiency in the financial disclosure process. These best practices create a solid foundation for negotiation, helping couples reach a fair settlement and move forward with clarity.

Seeking Professional Guidance for Financial Disclosure

Navigating the financial disclosure process in divorce can be complex and overwhelming. With so much at stake, it’s crucial to get professional advice to ensure you are making informed decisions and complying with the legal requirements.

Consulting a divorce attorney who specializes in financial disclosure can provide you with expert guidance and support throughout the process. They have the knowledge and experience to help you understand what information needs to be disclosed and how to present it effectively.

Getting professional advice can help you:

- Understand the legal requirements: A divorce attorney can explain the specific financial disclosure laws in your jurisdiction and ensure that you are meeting all the necessary obligations.

- Ensure compliance: By working with an attorney, you can rest assured that you are disclosing all the relevant financial information required by the court. They will help you gather and organize the necessary documents, ensuring nothing is overlooked.

- Optimize your financial disclosure: An experienced attorney can guide you on how to present your financial information in the most favorable way. They understand what factors the court considers and can help you highlight your strengths while addressing any potential weaknesses.

- Protect your interests: Divorce attorneys are trained to advocate for their clients’ best interests. They will ensure that your rights are protected throughout the financial disclosure process and help you negotiate a fair settlement.

Additionally, consulting a financial advisor who specializes in divorce can provide further insights and guidance. They can help you understand the tax implications of different financial arrangements and create a comprehensive financial plan for your post-divorce life.

Remember, making mistakes or overlooking important financial details during the disclosure process can have long-term consequences. Seeking professional guidance can help you navigate the complexities of divorce and ensure that you are making informed decisions for your future.

Featured image:

Seeking professional guidance is crucial when navigating the financial disclosure process in divorce. A divorce attorney and financial advisor can offer expert insights, ensure compliance, and help you present your financial information effectively. Don’t hesitate to reach out to these professionals for the support you need during this critical time.

Maintaining Financial Transparency After Disclosure

Financial transparency should not end with the initial disclosure process. It is crucial to continue practicing ongoing communication and honesty regarding financial matters throughout the divorce process. By doing so, couples can avoid disputes and promote a smoother negotiation process for future decisions related to property division, support, and other financial matters.

Regular and open communication about financial matters allows both parties to stay informed and make informed decisions. This ongoing transparency ensures that both spouses have a clear understanding of their financial situation and can actively participate in discussions about division of assets, spousal support, and other financial aspects of the divorce settlement.

By maintaining financial transparency, couples can work together more effectively to resolve any potential conflicts or disagreements that may arise during the divorce process. Sharing financial information openly creates an atmosphere of trust and fairness, which is essential for achieving a mutually satisfactory settlement.

In addition to open communication, it is important to continue prioritizing honesty in all financial matters. Divorce settlements rely on accurate and truthful disclosures, and any attempts to hide or manipulate financial information can have significant legal and financial consequences.

“Honesty is the cornerstone of a fair and just divorce settlement. By maintaining financial transparency, couples can navigate the divorce process with integrity, ensuring that both parties are treated equitably.”

To further emphasize the importance of ongoing financial communication, here are some practical tips to help you maintain financial transparency in your divorce:

- Set up regular meetings or check-ins dedicated to discussing financial matters.

- Share relevant financial documents and updates promptly with each other.

- Stay informed about any changes or updates in your financial situation.

- Be open to compromise and negotiations based on your financial circumstances.

- Consider seeking professional guidance, such as consulting with a divorce attorney or financial advisor, to facilitate ongoing financial communication.

Remember, the goal of maintaining financial transparency is to reach a fair and reasonable divorce settlement that considers the needs and rights of both parties involved. Ongoing communication and honesty contribute to a smoother and more efficient divorce process, ultimately benefiting everyone involved.

| Benefits of Maintaining Financial Transparency |

|---|

| 1. Enhanced trust and fairness in the divorce process |

| 2. Facilitation of effective communication and negotiation |

| 3. Prevention of disputes and potential legal consequences |

| 4. Optimal decision-making based on accurate financial information |

| 5. Promotion of a smoother and more efficient divorce process |

Conclusion

Sharing financial information is an essential part of the divorce process to ensure a fair and equitable settlement. By following the steps outlined in this article, including gathering necessary documents, filling out the required forms accurately, and maintaining transparency, you can navigate the financial disclosure process effectively. It is crucial to be upfront and truthful during this process to avoid potential penalties and loss of credibility in court.

Financial disclosure is important for both parties to make informed decisions regarding property division, spousal support, and other financial matters. By sharing comprehensive details about assets, debts, income, and expenses, both spouses can evaluate the financial situation and negotiate a fair settlement. Financial transparency promotes fairness, efficiency, and credibility in the divorce process.

Remember to seek professional guidance when needed, such as consulting a divorce attorney or financial advisor. These experts can provide valuable insights on legal requirements, ensure compliance, and offer guidance on how to present your financial information effectively. Additionally, maintaining ongoing financial communication and honesty throughout the divorce process can help avoid disputes and promote a smoother negotiation process for future decisions related to property division, support, and other financial matters.

Financial disclosure is important in divorce because it allows both parties to make informed decisions about property division, spousal support, and other financial matters. It promotes fairness, efficiency, and credibility in the divorce process.

If you initiated the divorce as the petitioner, you must share your financial information within 60 days after filing the Petition. If you filed a response as the respondent, you have 60 days after filing the Response to share your financial information.

You will need to gather documents such as tax returns from the past two years, proof of income for the last two months (such as pay stubs), documents outlining your assets and debts, mortgage statements, bank account statements, credit card statements, and retirement account statements. You will need to fill out three forms: the Declaration of Disclosure (form FL-140), the Income and Expense Declaration (form FL-150), and the Schedule of Assets and Debts (form FL-142) or Property Declaration (form FL-160). These forms provide a comprehensive overview of your financial situation.

After completing the forms and attaching the required documents, make copies of everything for your spouse. These copies should not be filed with the court but should be sent to your spouse for review. Keep the original set of forms and attachments in a safe place.

Failure to provide accurate and complete financial information can lead to penalties such as being held in contempt of court, monetary sanctions, the award of assets to the other spouse, and the setting aside of agreements or decisions related to property or spousal support.

To ensure a smooth financial disclosure process, prioritize the task, gather all necessary documents, fill out the required forms accurately and honestly, make copies of everything, and send the copies to your spouse. Seek professional guidance when needed and prioritize ongoing financial communication.

Yes, seeking professional guidance from a divorce attorney or financial advisor can provide valuable insights. These experts can help you understand the legal requirements, ensure compliance, and offer guidance on how to present your financial information effectively. Maintaining ongoing communication and honesty regarding financial matters after disclosure can help avoid disputes and promote a smoother negotiation process for future decisions related to property division, support, and other financial matters.

FAQ

Why is financial disclosure important in divorce?

What are the deadlines for sharing financial information in divorce?

What documents do I need to gather for financial disclosure in divorce?

What forms do I need to fill out for financial disclosure in divorce?

What should I do with the copies of the financial disclosure documents?

What are the consequences of incomplete or dishonest financial disclosures?

What are some tips for a smooth financial disclosure process in divorce?

Should I seek professional guidance for financial disclosure in divorce?

Why is maintaining financial transparency important after disclosure?

What are the key components of financial disclosure in divorce cases, and how can they be effectively managed in Massachusetts?

In Massachusetts divorce cases, financial disclosure statements are crucial components. These statements should include all assets, liabilities, income, and expenses. To effectively manage them, parties should work with legal and financial professionals to ensure accurate and thorough documentation. Full disclosure is essential to fair and equitable resolutions.

Source Links

- https://selfhelp.courts.ca.gov/divorce/financial-disclosures

- https://selfhelp.courts.ca.gov/divorce/financial-disclosures/gather-share

- https://www.modernfamilylaw.com/resources/financial-disclosures-in-a-california-divorce/

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Financial Planning and Budgeting

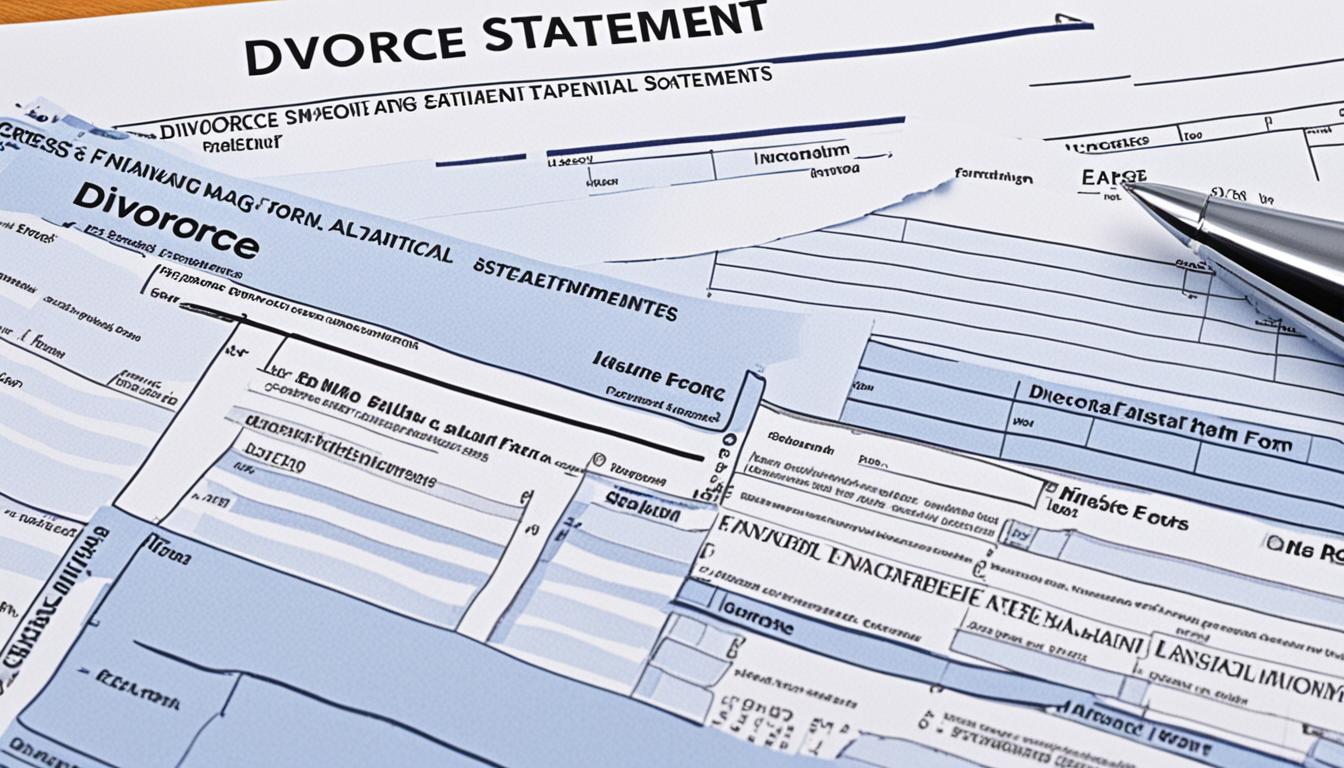

Divorce Financial Statement Guide: How to Fill Out

Did you know that accurately filling out a financial statement is crucial for reaching a fair and just agreement in a divorce? Mistakes or inaccuracies could result in serious consequences, including fines and damage to your reputation.

After filing for divorce, one of the important tasks is filling out a financial statement. This document provides the court with an overview of your income, expenses, and assets. It is crucial to be honest and thorough while filling out the financial statement, as any omissions or misrepresentations can have serious consequences, including penalties and damage to your credibility. The form may vary depending on your location, but the purpose remains the same – to give the court an accurate snapshot of your financial situation. It is essential to gather supporting documentation, such as tax returns, pay stubs, financial statements, and bills, to verify the information you provide.

Key Takeaways:

- Accurately filling out a financial statement is crucial for a fair and equitable divorce settlement.

- Mistakes or misrepresentations in the financial statement can lead to penalties and damage to your credibility.

- Gather supporting documentation to verify the information provided in the financial statement.

- Be honest and thorough while filling out the financial statement to provide an accurate snapshot of your financial situation.

- The financial statement helps the court make decisions regarding support, property division, and attorney fees.

Why is the Financial Statement Important in Divorce?

The financial statement plays a crucial role in the divorce process as it is used by the court to make decisions regarding spousal support, child support, attorney fees, and property division. It provides a comprehensive overview of your financial situation and helps the judge assess your ability to pay or receive support.

Considered a sworn statement under penalty of perjury, any deliberate misrepresentations can lead to penalties or even legal consequences. Accurate and detailed information in the financial statement is vital for a fair and equitable divorce settlement.

By providing a clear picture of your income, expenses, and assets, the financial statement assists the court in determining appropriate support payments, dividing marital property, and ensuring that the financial needs of both parties and any children involved are met.

The financial statement is like a financial snapshot of your life during the divorce process. It is an essential document that provides transparency and allows the court to make informed decisions based on your financial situation.” – Family Law Attorney, Jane Wilson

With the financial statement serving as a key factor in divorce proceedings, it is crucial to be diligent and accurate while filling it out. Providing misleading or incomplete information can lead to unfair outcomes and damage your credibility in the eyes of the court.

Next, we will explore the specific documentation required for the financial statement to ensure a comprehensive and accurate representation of your financial situation.

Key Points

| Financial Statement in Divorce | Importance |

|---|---|

| Used by the court to make decisions | To assess ability to pay/receive support |

| Sworn statement under penalty of perjury | Deliberate misrepresentation can lead to penalties |

| Provides a comprehensive financial snapshot | Aids in fair and equitable settlement |

| Key factor in determining support payments and property division | Ensures financial needs are met |

Now that you understand the importance of the Financial Statement in Divorce, let’s delve into the specific documentation required to support your financial disclosures.

What Documentation is Required for the Financial Statement?

To accurately fill out a financial statement, you will need to gather various documents that support your income, expenses, and assets. Providing accurate and up-to-date documentation is crucial to back up the information you include in your financial statement.

Some common documents required for the financial statement include:

- Tax returns for the previous years: These help provide a comprehensive view of your income and deductions.

- Pay stubs: These documents show your regular income and any additional earnings.

- Financial statements from bank accounts, credit cards, and retirement accounts: These statements offer an overview of your assets and liabilities.

- Real estate information: Documenting property ownership and any mortgages or loans connected to it is essential.

- Loan details: If you have any outstanding loans, such as a car loan or student loan, gather relevant information about those debts.

- Bills: Collect bills for utilities, insurance, childcare, and other regular expenses to accurately represent your monthly financial obligations.

Gathering these documents ensures that you have the necessary evidence to support the figures you provide in your financial statement.

Having all the necessary documentation ready will help you accurately complete your financial statement and present an accurate representation of your financial situation to the court.

Tips for Filling Out the Financial Statement

Filling out the financial statement can be a complex task, but following some tips can make the process smoother.

- Calculate your income carefully: Include all sources of income and average variable income over a specific period. This ensures that you provide an accurate representation of your financial situation.

- Thoroughly document your expenses: Include all necessary categories and be detailed in recording your expenses. Additionally, utilize averages for expenses that are incurred irregularly to provide a comprehensive overview.

- Gather supporting documentation: It is crucial to gather all appropriate documentation to support the information you provide in your financial statement. This includes tax returns, pay stubs, financial statements, and bills. Having this documentation ready will help verify the accuracy of the information you provide.

- Avoid double-dipping: Ensure that you list your expenses only once. Double-dipping can lead to inaccuracies and misrepresentations, which may have consequences during the divorce proceedings.

- Designate separate property accurately: If you have separate property that is not subject to division, make sure to accurately designate it in your financial statement. Provide all necessary attachments or documentation to support the separate property claim.

If you have any questions or need assistance in completing the financial statement accurately, it is advisable to seek guidance from your attorney. They can provide you with the necessary expertise and ensure that you navigate the process effectively.

Image: Illustration of a person organizing financial documents for a financial statement.

Understanding the Categories in the Financial Statement

The financial statement is a comprehensive document that provides an overview of your financial situation during divorce proceedings. It is divided into various categories, each representing different aspects of your financial life. Understanding these categories and accurately filling them out is essential to present a complete picture to the court.

Here are the key categories typically included in a financial statement:

1. Personal Information

This section includes basic personal details such as your name, address, contact information, and social security number.

2. Gross Weekly Income from All Sources

Here, you need to list all sources of income including wages, self-employment income, rental income, dividends, and any other form of regular income.

3. Itemized Deductions from Gross Income

In this category, you should list all allowable deductions such as federal and state taxes, healthcare costs, retirement contributions, and any other deductions that reduce your gross income.

4. Adjusted Net Weekly Income

This section calculates your adjusted net weekly income by subtracting the itemized deductions from your gross weekly income. It represents your disposable income after deducting allowable expenses.

5. Other Deductions from Salary

If you have any additional deductions such as union dues, health insurance premiums, or other mandated payments, this is where you would list them.

6. Net Weekly Income

This category represents your net weekly income after deducting both itemized deductions from gross income and other deductions from salary.

7. Gross Yearly Income from the Prior Year

Here, you need to provide your total gross income from the previous year, including any bonuses, commissions, or other forms of income received during that period.

8. Weekly Expenses

This section requires you to list your weekly expenses, including housing costs, utilities, transportation expenses, healthcare costs, childcare expenses, and any other regular living expenses.

9. Assets

Include all your assets in this category, such as real estate, vehicles, investments, bank accounts, retirement accounts, and any other valuable possessions.

10. Liabilities

Here, you should list all your liabilities, including mortgages, loans, credit card debts, and any other outstanding debts or obligations you have.

By accurately providing the necessary information under each category, you can ensure that the court has a clear understanding of your financial situation, thereby facilitating fair and informed decisions during the divorce proceedings.

How to Calculate Income and Expenses in the Financial Statement

Calculating income in the financial statement involves accurately reporting your income from various sources. This includes base pay, self-employment income, social security, public assistance, rental income, and other sources. It may require averaging variable income over a specific period to provide a more accurate representation of your earnings. By carefully considering all sources of income, you can ensure that your financial statement reflects your true earning capacity.

On the other hand, calculating expenses in the financial statement requires a thorough assessment of various categories. These categories typically include housing, utilities, transportation, childcare, healthcare, and others. It is important to provide accurate and detailed information in the expense section to present a comprehensive overview of your financial obligations. By diligently accounting for all relevant expenses, you can paint a clearer picture of your financial situation.

When calculating both income and expenses in the financial statement, it is crucial to be meticulous in your approach. Double-check your calculations and ensure that you have accurately accounted for all relevant figures. By taking the time to accurately calculate your income and expenses, you can present a thorough and reliable financial statement that will aid in the divorce process.

Example:

| Income Sources | Amount |

|---|---|

| Base Pay | $4,500 |

| Self-Employment Income | $2,000 |

| Social Security | $1,200 |

| Public Assistance | $500 |

| Rental Income | $1,000 |

| Other Sources | $500 |

| Expense Categories | Amount |

|---|---|

| Housing | $2,500 |

| Utilities | $500 |

| Transportation | $300 |

| Childcare | $1,000 |

| Healthcare | $400 |

| Other Expenses | $600 |

Common Mistakes to Avoid in Filling Out the Financial Statement

Filling out the financial statement accurately is crucial to ensure a fair and equitable divorce settlement. To avoid mistakes, it is important to be thorough, honest, and organized. Common mistakes to avoid include:

- Not including all income sources: It is essential to report all sources of income, including salary, self-employment income, rental income, and any other financial resources. Failure to include any income sources can lead to an inaccurate representation of your financial situation.

- Not accurately documenting expenses: Be meticulous in documenting your expenses and include all necessary categories. Ensure that you account for regular and irregular expenses to provide an accurate overview of your financial obligations.

- Double-dipping expenses: Avoid listing the same expense multiple times in different categories. It is important to report each expense only once to avoid inflating your financial obligations.

- Not providing supporting documentation: Failing to include the necessary supporting documentation can raise doubts about the accuracy of your financial statement. Gather and attach all relevant documents, such as bank statements, tax returns, and bills, to back up the information provided.

- Incomplete or incorrect information: Take the time to carefully review and fill out each section of the financial statement. Incomplete or incorrect information can lead to misunderstandings, delays, or even legal consequences.

- Failing to disclose separate property: It is crucial to disclose all separate property, such as assets acquired before the marriage or through inheritance. Failure to do so can impact the division of assets during the divorce proceedings.

Being vigilant and paying attention to detail can help you avoid these common mistakes when filling out the financial statement. Take the time to review the form, gather all necessary documentation, and consult with your attorney if you have any questions or concerns.

Importance of Accuracy in the Financial Statement

Accuracy is of utmost importance when filling out the financial statement. The financial statement serves as a roadmap for the court to allocate support payments, divide assets and debts, and make decisions related to the divorce settlement. Any inaccuracies or misrepresentations can lead to unfair outcomes and damage your credibility in the eyes of the court. It is essential to provide honest, detailed, and verifiable information in the financial statement to ensure a fair and just resolution to your divorce case.

Why Accuracy Matters

An accurate financial statement provides a clear and comprehensive picture of your financial situation, enabling the court to make informed decisions. By presenting accurate income, expenses, assets, and liabilities, you help ensure a fair distribution of marital property, appropriate support payments, and a reasonable resolution to your divorce proceedings.

The Consequences of Inaccuracy

Any inaccuracies or misrepresentations in the financial statement can have serious consequences. They can lead to an unfair division of assets or support payments, causing financial hardships or discrepancies. Moreover, if the court discovers deliberate misrepresentations, it can affect your credibility and trustworthiness, potentially jeopardizing your case.

“An accurate and detailed financial statement is the cornerstone of a fair and equitable divorce settlement.

Tips for Ensuring Accuracy

To ensure accuracy in your financial statement, follow these tips:

- Take your time: Take the necessary time to gather all the required documents and information before filling out the financial statement.

- Be meticulous: Double-check all the numbers, figures, and supporting documentation to ensure accuracy.

- Provide complete information: Include all relevant details about your income, expenses, assets, and liabilities. Leaving out information can lead to misconceptions or misunderstandings during the divorce proceedings.

- Seek professional assistance: If you’re unsure about any aspect of the financial statement or need guidance, consult with an experienced family law attorney who can provide expert advice and ensure accuracy.

| Importance of Accuracy in the Financial Statement |

|---|

| Avoids unfair outcomes in the division of assets and support payments. |

| Preserves your credibility and trustworthiness in the eyes of the court. |

| Leads to a fair and just resolution of your divorce case. |

Seek Professional Guidance for Filling Out the Financial Statement

Filling out the financial statement accurately and comprehensively can be a challenging task. That’s why it’s highly recommended to seek professional help and guidance to ensure that you provide accurate and detailed information. An experienced family law attorney can offer valuable assistance throughout the process, ensuring that everything is filled out correctly and in accordance with legal requirements.

An attorney can provide expert guidance to help you gather the necessary documents for your financial statement. They can advise you on which specific documents are required, such as tax returns, pay stubs, bank statements, and other financial records. This ensures that you have all the necessary supporting documentation to back up the information you provide.

Additionally, an attorney can assist you in accurately calculating your income and expenses. They understand the complexities involved in assessing various income sources and accounting for different types of expenses. With their professional knowledge, they can help you minimize errors and ensure that your financial statement presents an accurate financial picture.

Understanding the categories and sections of the financial statement can be daunting. However, an experienced attorney can provide you with valuable insights and explanations, helping you navigate through the different sections of the form. They can guide you in accurately filling out each category, ensuring that you provide the necessary details and information as required by the court.

Advantages of Seeking Professional Help

When you seek attorney assistance for your financial statement, you benefit from their expertise and experience in handling divorce cases. They have a deep understanding of the legal requirements and processes involved, ensuring that your financial statement is filled out correctly and in compliance with the law.

By consulting with an attorney, you gain peace of mind knowing that you have professional support throughout the process. They can answer any questions you may have, clarify any doubts, and provide you with the guidance you need to navigate the complexities of filling out the financial statement.

Moreover, by having an attorney assist you, you increase the chances of a successful outcome in your divorce case. They can help you present a comprehensive, accurate, and persuasive financial statement that supports your interests and protects your rights. This can lead to a more favorable divorce settlement and ensure that your financial situation is appropriately considered by the court.

Overall, seeking professional help with your financial statement is a wise decision. It saves you time, reduces stress, and enhances the accuracy and credibility of your financial disclosure. Investing in professional guidance ensures that you provide a comprehensive and accurate overview of your financial situation, increasing the likelihood of a fair and equitable divorce settlement.

By seeking assistance from an experienced family law attorney, you can navigate the complexities of the financial statement with confidence, knowing that you have the support and expertise needed to present your financial information accurately and effectively.

Conclusion

Filling out the financial statement is a critical step in the divorce process. It requires careful organization, accurate calculation of income and expenses, and gathering supporting documentation. The importance of accuracy and honesty cannot be overstated, as it ensures a fair and equitable divorce settlement.

Seeking professional guidance from an experienced family law attorney can greatly assist in filling out the financial statement accurately and comprehensively. An attorney can provide valuable advice on which documents to gather, help in calculating income and expenses, and ensure a thorough understanding of the different categories and sections of the financial statement.

By following the tips and guidelines provided in this guide, you can navigate the complexities of filling out the financial statement with confidence. Remember to be diligent in gathering all the necessary documentation and providing accurate and detailed information. This will help you present an accurate financial picture to the court, increasing the chances of a successful outcome in your divorce case.

FAQ

How do I fill out a financial statement for divorce?

To fill out a financial statement for divorce, you need to be thorough, honest, and organized. Gather all necessary documentation to support your income, expenses, and assets. Calculate your income carefully, including all sources and averaging variable income. Document your expenses accurately, including all necessary categories and utilizing averages for irregular expenses. Seek guidance from your attorney if needed.

Why is the financial statement important in a divorce?

The financial statement plays a crucial role in the divorce process as it provides the court with an accurate snapshot of your financial situation. It is used by the court to make decisions regarding spousal and child support, attorney fees, and property division. It is considered a sworn statement under penalty of perjury, and any deliberate misrepresentations can lead to penalties or legal consequences.

What documentation is required for the financial statement?

To fill out the financial statement accurately, you need to gather various documents that support your income, expenses, and assets. Some common documents include tax returns, pay stubs, financial statements from bank accounts, credit cards, and retirement accounts, real estate information, loan details, and bills.

What are some tips for filling out the financial statement?

When filling out the financial statement, calculate your income carefully, be thorough in documenting your expenses, gather all appropriate documentation, avoid double-dipping expenses, designate separate property accurately, and seek guidance from your attorney if needed.

What are the categories in the financial statement?

The financial statement is typically divided into categories such as personal information, income, deductions, net income, yearly income, expenses, assets, and liabilities. Each category represents a different aspect of your financial situation.

How do I calculate income and expenses in the financial statement?

Calculating income involves accurately reporting your income from various sources, including base pay, self-employment income, social security, rental income, and more. Calculating expenses requires careful consideration of various categories, such as housing, utilities, transportation, childcare, healthcare, and others.

What are common mistakes to avoid in filling out the financial statement?

Common mistakes to avoid include not including all income sources, not accurately documenting expenses, double-dipping expenses, not providing supporting documentation, incomplete or incorrect information, and failing to disclose separate property. Being thorough and paying attention to detail can help avoid these mistakes.

Why is accuracy important in the financial statement?

Accuracy is essential in the financial statement to ensure a fair and equitable divorce settlement. Any inaccuracies or misrepresentations can lead to unfair outcomes and damage your credibility in the eyes of the court. Providing honest, detailed, and verifiable information is crucial.

Should I seek professional guidance for filling out the financial statement?

Seeking professional guidance from an experienced family law attorney can greatly simplify the process and ensure that you provide accurate and detailed information. An attorney can assist in gathering the necessary documents, calculating income and expenses, understanding the categories, and ensuring everything is filled out correctly.

What is the conclusion on filling out the financial statement?

Filling out the financial statement for divorce is a crucial step that requires accuracy, honesty, and organization. It is important to gather all necessary documentation, calculate income and expenses carefully, and avoid common mistakes. Seeking professional guidance can greatly assist in filling out the financial statement accurately and comprehensively.

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

Financial Planning and Budgeting

What Are California's Divorce Financial Disclosure Requirements?

Wade through the layers of California's divorce financial disclosures to unravel the intricate web of assets and debts that shape divorce settlements.

Deciphering the financial disclosure requirements for divorce in California is like peeling back the layers of an onion, revealing the intricate financial groundwork that underpins the end of a marriage. By detailing assets and debts, as well as outlining income and expenses, these requirements have a substantial impact on the eventual outcome of divorce agreements.

Understanding the nuances of these financial disclosures is key to ensuring a fair and equitable resolution. So, what exactly do these requirements entail, and how do they impact the divorce process?

Key Takeaways

- Timely preliminary financial disclosures within 60 days are crucial in California divorces.

- Mandatory forms like FL-140, FL-150, FL-142, and FL-141 ensure full financial transparency.

- Incomplete disclosures can lead to legal consequences and financial penalties.

- Transparent financial reporting is essential for fair settlements and court decisions.

Disclosure Deadline in California Divorce

When filing for divorce in California, meeting the 60-day deadline for submitting preliminary financial disclosures is a crucial step in the legal process. Both parties must share all relevant financial information by completing the required forms. Failure to disclose financial documents timely can result in delays and affect the fairness of settlements.

The Declaration of Disclosure form must be filed with the court and served on the other party within the specified timeframe. This document includes details of assets, debts, income, and expenses. Providing accurate and comprehensive financial disclosures is essential for transparency and ensuring that both parties have a clear understanding of the financial landscape in the divorce proceedings.

It's imperative to adhere to the disclosure deadline to facilitate a smoother divorce process and avoid potential complications down the line. By sharing the necessary financial information promptly, the divorce proceedings can progress efficiently and fairly.

Required Financial Documents in Divorce

In a California divorce, the required financial documents play a crucial role in ensuring full transparency and compliance with state laws. These documents, including the Declaration of Disclosure (form FL-140), Income and Expense Declaration (form FL-150), Schedule of Assets (form FL-142), and Proof of Service (form FL-141), are essential components of divorce financial disclosure. The Declaration of Disclosure mandates each party to provide comprehensive information about their financial status, assets, and debts. The Income and Expense Declaration requires a detailed breakdown of income sources, expenses, and financial obligations. The Schedule of Assets is crucial for listing all assets, their values, and any separate or community property distinctions. Proof of Service is necessary to confirm that the financial documents have been exchanged between the parties. By adhering to these requirements, individuals ensure compliance with California divorce laws and maintain the necessary level of financial transparency throughout the divorce process.

| Required Financial Documents | Form Number |

|---|---|

| Declaration of Disclosure | FL-140 |

| Income and Expense Declaration | FL-150 |

| Schedule of Assets | FL-142 |

| Proof of Service | FL-141 |

Completing Mandatory Disclosure Forms

To ensure compliance with California divorce laws and facilitate fair settlements, completing the mandatory disclosure forms is imperative for both parties involved in the divorce proceedings.

The Declaration of Disclosure, including forms such as the Income and Expense Declaration (FL-150) and the Asset Declaration (FL-142), is essential for achieving financial transparency. These forms require a comprehensive disclosure of each party's financial status, ensuring that all relevant information is provided for a fair division of assets and liabilities.

Additionally, completing the Proof of Service form (FL-141) is crucial to demonstrate that the necessary documents have been properly served to the other party. By adhering to these requirements and providing accurate and complete forms, both parties contribute to the integrity of the financial disclosure process, ultimately leading to more equitable divorce settlements.

It's essential to carefully complete these forms to avoid delays or complications in the divorce proceedings.

Consequences of Incomplete Disclosures

Inadequate financial disclosures during divorce proceedings can result in severe legal consequences, including contempt of court and monetary sanctions for non-disclosure or provision of false information.

In California divorce cases, failure to fully disclose financial information can lead to contempt of court charges if the non-disclosure is willful or intentional. Monetary sanctions may be imposed to cover the other party's attorney fees incurred in discovering the incomplete disclosures. Additionally, the court may award assets to the other spouse as a penalty for the incomplete disclosures.

If hidden assets or lies are uncovered post-divorce, agreements may be set aside, leading to further legal complications and financial repercussions. Moreover, the effects of delayed proceedings, loss of trust, and increased legal fees due to dishonesty can exacerbate the already stressful divorce process. Therefore, ensuring complete and transparent financial disclosures is crucial in California divorce proceedings to avoid these serious consequences.

Importance of Transparent Financial Reporting

Transparent financial reporting in California divorce cases is essential to uphold the integrity of the legal process and ensure equitable outcomes for all parties involved. Full disclosure of assets, debts, income, and expenses is mandated by California law to guarantee a fair resolution.

By providing accurate and transparent financial information, parties enable the court to make informed decisions based on all relevant factors. Failure to adhere to these reporting requirements can impede the court's ability to achieve equitable outcomes, potentially leading to unjust results.

Honesty and accuracy in financial disclosure not only promote fairness but also enhance transparency throughout the divorce process. Therefore, it's imperative for individuals involved in California divorce proceedings to prioritize complete and precise financial reporting to facilitate a just and equitable resolution of their marital affairs.

Compliance with these requirements is fundamental to maintaining the integrity of the legal system and fostering trust among all parties involved.

Frequently Asked Questions

Is Financial Disclosure Required for Divorce in California?

Yes, financial disclosure is required for divorce in California. It ensures fair outcomes in matters like child support and property division. Full transparency is mandated by law for equitable decisions. Lack of disclosure impedes informed judgments.

What Are the Final Disclosures for Divorce in California?

We ensure final disclosures in California divorce by completing forms FL-140, FL-150, and FL-142. It's crucial to serve form FL-141 for proof. These disclosures guarantee full financial transparency, a vital step before finalizing divorce proceedings and ensuring equitable outcomes.

Is California a Mandatory Disclosure State?

Yes, California is a mandatory disclosure state, requiring parties in a divorce to provide detailed financial information. Failure to disclose can result in penalties. Full financial transparency is essential for fair divorce settlements.

What Assets Are Protected in Divorce in California?

In California, assets acquired before marriage, received as gifts or inheritances during marriage, or designated as separate property are safeguarded in divorce. Community property, usually earned during marriage, is subject to division.

Conclusion

In conclusion, adhering to California's divorce financial disclosure requirements is crucial for a fair and transparent legal process. Failing to disclose financial information can lead to penalties and complications in property division and support decisions. Just as each piece of a puzzle fits together to form a complete picture, accurate and timely financial disclosure forms the foundation for a smooth and equitable divorce settlement.

Transparency is key in navigating the complexities of divorce proceedings in California.

Understanding the financial implications of divorce can be daunting. Christopher, our Financial Strategist, makes it accessible and manageable. He offers strategic insights into financial planning, asset division, and budgeting during and after divorce. Christopher’s guidance is invaluable for anyone looking to navigate the financial challenges of divorce with confidence and clarity.

-

Life After Divorce1 month ago

Life After Divorce1 month agoTD Jakes: Life After Divorce – A Journey of Healing

-

Supporting Children Through Divorce2 weeks ago

Supporting Children Through Divorce2 weeks agoPositive Effects of Divorce on Children: A Guide to Understanding

-

Navigating the Divorce Process4 weeks ago

Navigating the Divorce Process4 weeks agoUnderstanding Dominican Republic Divorce Law

-

Navigating the Divorce Process3 weeks ago

Navigating the Divorce Process3 weeks agoNavigating the Complexity: Divorce Document Preparation Services Explained

-

Coping Strategies3 weeks ago

Coping Strategies3 weeks ago10 Emotional Support Techniques for Coping With Divorce

-

Financial Aspects2 weeks ago

Financial Aspects2 weeks agoFinancial Advisor's Guide to Navigating Divorce Finances

-

Navigating the Divorce Process3 weeks ago

Navigating the Divorce Process3 weeks agoDivorce Lawyers New Orleans: Your Ultimate Guide to Legal Separation and Family Law

-

Navigating the Divorce Process3 weeks ago

Navigating the Divorce Process3 weeks agoNavigating Divorce with a Muslim Divorce Lawyer